Archive

LTE-Advanced deployments – Tracking the fastest wireless networks globally

In an earlier article written on this site in May 2013 (LTE Advanced – Key features and differentiators), I had discussed technical details of LTE-A. Sometimes called 4.5G, the technology was in testing stages at that time. Commercial deployment took off in different parts of the world about an year ago. The promise of LTE-Advanced is live and real as we head into 2015. Let us look at 10 operators that have taken the lead on LTE-A. For the sake of variety, only one operator has been taken from a particular country. Their region of operation, spectrum bands and top download speeds under ideal conditions are also listed. Only a few devices support LTE-A technology so far although many more are in the offing. If a device supporting LTE-A is available on a particular network, that would be included in this post too. Readers could refer to the earlier article on this blog for an explanation of technical terminologies.

SK Telecom, South Korea – Korean operators maintained their global telecom lead when SK Telecom unveiled LTE-A services in Seoul in June 2013. Its plan is to cover the whole country by the beginning of next year. SK Telecom used the Samsung Galaxy S5 to show speeds of 225 Mbps on the LTE-A network by combining 20 MHz spectrum from 800 MHz and 10 MHz spectrum from 1800 MHz band. Advanced techniques like Coordinated Multi Point (CoMP) transmission and Enhanced Inter-Cell Interference Coordination (eICIC) are also being put to use by the telco. Evolving to combine more bands, SK Telecom has announced the capability to aggregate total 40 MHz of bandwidth from 800 MHz, 1800 MHz and 2100 MHz, thus making download speeds of up to 300 Mbps a reality. Data rate as high as 450 Mbps was also tested recently by the operator.

MegaFon, Russia – During the Sochi Winter Olympics in February this year, MegaFon demonstrated its LTE-Advanced network clocking download speeds near 300 Mbps. The deployment was done in 2600 MHz by using 20 MHz of MegaFon’s and 20 MHz of its subsidiary Scartel’s spectrum. First commercially launched in Moscow, LTE-A was recently deployed in St. Petersburg with more Russian cities expected to be covered soon. Samsung Galaxy Note Edge was MegaFon’s first device for LTE-Advanced.

STC, Saudi Arabia – STC is one of the biggest service providers’ in the Middle-East. It launched LTE-Advanced in the kingdom in February 2014. The network is unique in the sense that it combines two 20 MHz LTE-TDD airwaves in the 2300 MHz band to achieve a speed of 225 Mbps. Recently, the carrier also demonstrated TDD-FDD carrier aggregation using 1800 MHz and 2300 MHz spectrum. Not much information is available about the current coverage or device support for STC’s network.

AT&T, USA – In March this year, Ma Bell declared the launch of LTE-Advanced in Chicago. AT&T claims speeds of up to 110 Mbps by aggregating a total of 15 MHz bandwidth from its 700 MHz and 2100 MHz AWS band. Rumors are that New York, San Francisco, Dallas and Washington DC are all ready for LTE-A. But consumers’ ability to experience such speeds is limited by device availability. AT&T’s Unite hotspot is the only device that supports LTE-A but much more action is expected on the phone front next year.

SingTel, Singapore – SingTel first showed off its LTE-A network in May this year. Commercial launch followed in summer and more than half of island has been covered already. Nationwide coverage is expected by next spring. SingTel claims top data rate of 300 Mbps. The operator has combined 20 MHz of bandwidth each from 1800 MHz and 2600 MHz bands. Huawei E5786 MiFi hotspot was the first compatible device. Subsequently, Samsung delivered the Galaxy S5 4G+ version of their flagship phone that took full advantage of SingTel’s fastest data speeds.

Swisscom, Switzerland – Swisscom rolled out LTE-Advanced in June this year starting from Berne and Lausanne stations. It was extended to cover the whole city of Berne and a few other urban areas in July. LTE-A will also be available in Zurich, Geneva and Lucerne soon. Like other carriers, Swisscom too went for carrier aggregation with 40 MHz total bandwidth from 1800 MHz and 2600 MHz bands. This resulted in speeds of about 300 Mbps. The telco pushed the limits further achieving data rates of 450 Mbps by combining 3 bands. It also declared that such superfast networks would be available in dense areas of this beautiful country by the end of next year. Compatible devices are also expected to be launched around that time only.

Bouygues Telecom, France – The third largest French mobile operator announced LTE-A or 4G+ services in June 2014. Lyon, Bordeaux and many other cities were covered by the end of summer. Speeds up to 220 Mbps have been achieved by Bouygues. Spectrum in 1800 MHz and 2600 MHz was aggregated for the LTE-Advanced network. The operator has also tested speeds of 300 Mbps by adding spectrum from 800 MHz to the above two bands for a total bandwidth of 45 MHz. Huawei’s 4G+ gateway and Bbox Nomad 4G+ hotspot are the first devices that support LTE-A on Bouygues’ network.

Vodafone, Spain – In October this year, Vodafone announced the deployment of LTE-Advanced in the Spanish cities of Madrid, Barcelona and Valencia. More cities are coming soon. By combining 20 MHz spectrum each from 1800 MHz and 2600 MHz, the operator was able to tout speeds of around 300 Mbps. Vodafone also plans to add the 800 MHz and 2600 MHz TDD spectrum to the above mix for LTE-A that could boost the data speed to 500 Mbps. Special version of Samsung Galaxy S5 will take advantage of Vodafone Spain’s superfast network.

Rogers Wireless, Canada – Canada’s largest carrier, Rogers declared the launch of its LTE-Advanced network with theoretical speeds of 150 Mbps couple of months ago. The service provider combined airwaves from its 700 MHz and 2100 MHz AWS holdings. Vancouver, Toronto, Calgary and many other cities were included in the launch. The latest iPhone 6 and Samsung Galaxy Note 4 with software updates will work on Rogers’ LTE-A network.

EE, United Kingdom – Britain’s EE went live with its LTE-Advanced network in October in the Central London area. Early next year, this 4G+ service will be extended to whole of London city apart from Birmingham, Liverpool and Manchester. Peak speeds of 300 Mbps have been delivered by aggregating 20 MHz spectrum each from 1800 MHz and 2600 MHz bands. Samsung Galaxy Note 4 and Samsung Galaxy Alpha will be compatible with the LTE-A network on EE.

Few other operators around the world that are deploying LTE-Advanced are Sprint USA, Vodafone Netherlands, Ooredoo Qatar, Telecom Italia and CSL Hong Kong. Carrier Aggregation still remains the most deployed feature of LTE-A. Higher order MIMO, eICIC and CoMP are expected over the next year or so. Deutsche Telekom in Germany demonstrated that carrier aggregation along with 4×4 MIMO can achieve speeds nearing 600 Mbps. Verizon Wireless in US plans to launch multi-feature LTE-Advanced in 2015. Not only will it aggregate 10 MHz airwaves from 700 MHz band with 20 MHz airwaves from AWS band, it will also deploy 4×4 MIMO and eICIC for an even faster LTE-A network. Now there is the argument that the telcos are jumping ahead of themselves when it comes to higher data rates. Do we need them and what about the supporting devices? However, there is always a need for speed and phones will arrive with time. Another interesting observation here is that Europe seems to be catching up and in some ways surpassing the LTE leader USA when it comes to LTE-Advanced. Asia is running along with Europe in terms of wireless data speeds. The wireless communications space keeps on getting more and more competitive. There is no scope for complacency or inertia.

What struggling operators worldwide can learn from T-Mobile, USA?

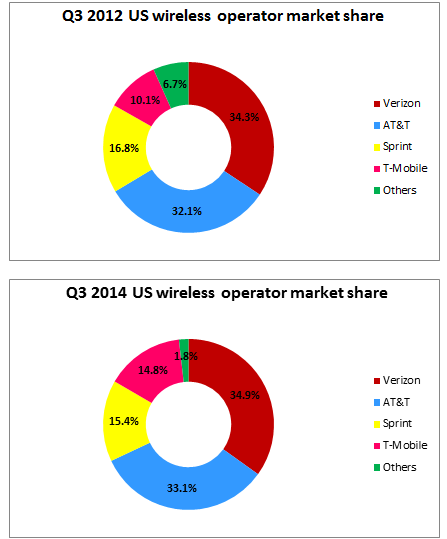

T-Mobile is the fourth largest wireless network operator by subscribers and revenue in the United States. Germany’s Deutsche Telekom owns two-third of the company. The telco manages to grab the most headlines out of any telecom company in the US because of some good reasons. Let us start by looking at a few numbers first. T-Mobile reported 3Q 2014 revenue of $7.35 billion and added about 2.35 million subscribers over the quarter (more than any other operator in the US). It has added 10 million customers in the last year and a half. The two comparison charts below should help explain the story. Considering that much of the subscriber growth is coming from non-phone categories for bigger carriers, it is clear that T-Mobile has managed a respectable growth in a saturated market. While some of this growth came from the acquisition of MetroPCS, the bottom line is that no other operator has managed a faster increase in the total number of connections. Note that the market share here includes wholesale numbers.

The turnaround of T-Mobile ironically started with AT&T’s failed acquisition of the company. As a reverse breakup fees, T-Mobile earned $3 billion in cash and rights to $1 billion worth of spectrum. The operator milked this wonderful opportunity and started off on the road to revival. The following content will shed light on how T-Mobile impacted the industry deeply and managed this revival. Indeed there are some lessons in here for those service providers that are losing both money and subscribers in this business –

- Leader can make a big difference – T-Mobile appointed John Legere as the CEO in September 2012. Much of T-Mobile’s recent success has been attributed to John’s maverick tactics. He dared to follow the ‘Un-carrier’ approach. Every few months, T-Mobile comes up with a tempting customer offer that becomes the talk of the industry. Known for his colorful personality, the company’s leader does not hesitate to take regular jabs at his competitors. Some may not like his style but it keeps up the aggression and instills confidence in both employees and customers.

- Innovation has to continue – There is no substitute to creativity and fresh ideas even in the face of adverse headwinds. This is risker for a struggling business, but still a far better option than the status quo. In a country where 2 year contracts and subsidized phones were prevalent, T-Mobile dared to introduce plans with no annual service contracts, faster upgrades and free international roaming. Such plans were music to the ear of customers, but were financially stressful for the operator. Nevertheless, innovation did not stop.

- Change the rules of the game – This flows directly from the point made above. Do not hesitate to take the untraveled road. T-Mobile started following this adage about 18 months ago and here is what they have done so far to get back into the market –

- Un-carrier 1.0 – Simple choice plan was introduced that offered unlimited voice, text and data for $70. Cheaper options were available with limited data. Annual contracts were eliminated and devices were not linked to the plan anymore. Phones could still be financed, but customer had the freedom to quit at their will.

- Un-carrier 2.0 – T-Mobile allowed upgrades to a new phone twice every year using the JUMP (Just Upgrade My Phone) plan. In other words, upgrade when you want to not when you are told to. Multiple options were available to trade-in the old phones and existing customers got same phone deals as the new ones. Phone insurance was included.

- Un-carrier 3.0 – Under the Simple Global plan, data and text were made free while roaming internationally in 100 countries. Voice calls were charged at 20 cents/minute. More countries are being added periodically. While the free data roaming is at slower speeds and special packs must be purchased for 3G or higher speeds, this still saves hundreds of dollars for many regular travelers.

- Un-carrier 4.0 – Perhaps the most consumer-friendly move, T-Mobile offered to pay up to $350 in ETF or the Early Termination Fees for subscribers willing to leave rival operators. Also as part of their fourth un-carrier strategy, they started offering cheaper iPads and plans with no overage charges.

- Un-carrier 5.0 – T-Mobile allowed anyone to test drive their network for a week with iPhone 5S. This was wonderful for those who were not sure about the T-Mobile network. It also helped raise awareness about the presence of iPhone with the nation’s fourth largest operator.

- Un-carrier 6.0 – Under the ‘Music Freedom’ initiative, music streaming from popular Internet radio services was made free and independent from the data limits. Pandora, Rhapsody, iHeart Radio and iTunes Radio were all in this list.

- Un-carrier 7.0 – With ‘Wi-Fi Unleashed’, every new smartphone from T-Mobile was made Wi-Fi calling and texting capable. This is great for customers living in a low network coverage area. The telco also begun offering an 802.11ac compatible Personal Hotspot last month to enable Wi-Fi calling using a home broadband connection. A new free in-flight texting and visual voicemail feature compatible with the Gogo service was also announced.

- Challenge the bigger players and they might follow you – Initially complacent about their strong position, the big two – Verizon and AT&T (and even Sprint) were forced to take note of the revolution ushered by T-Mobile in the American wireless space. Verizon’s Edge and AT&T’s Next were the early upgrade versions of these two service providers. Sprint too raced to match prices on their individual and family plans. T-Mobile was ultimately responsible for the never ending price wars that are great for the consumers. It has changed the concept of brand loyalty for good and aligned the US wireless industry more with global practices.

- Short term loss can be long term gain – All these strategies to attract new customers are obviously not coming for free. T-Mobile is gaining new subscribers but is taking a hit financially. While revenue momentum has continued, the telco lost $94 million or 12 cents a share in the most recent quarter. But this will not deter T-Mobile and its CEO. Once they can get enough subscribers to like their service, turning around operations to make them profitable would not be difficult. Deutsche Telekom’s backing provides a good support system.

- No substitute for good customer service – Irrespective of the business you run, the importance of customer service cannot be underestimated. This is even more significant for a telecom service provider who directly deals with the customer. Poor network quality, inflated bills and adding or removing services are some of the top issues that reach a carrier’s service center. Think about how we all frequently grumble about inept customer service from the mobile telecom provider. However on a relative basis, T-Mobile has been frequently ranked above its competitors through the years on this parameter. Few years ago when I was their customer, this remained an aspect I liked about their service. Both T-Mobile and their MetroPCS brand topped the JD Power’s latest 2014 Wireless Customer Care Ratings.

- Never ignore network quality – The quality of network along with pricing remains the core factor in the customer decision making process. Even a struggling operator should not undermine the network. Along with all their Un-carrier moves, T-Mobile has been enhancing the network at a faster pace as compared to its rivals. It was already building out the LTE network towards the end of 2011. This deployment was accelerated after they got cash and spectrum from AT&T. 250 million US residents are covered by the T-Mobile LTE network currently and the operator expects to reach more than 300 million people in another year or so. Remember, getting to those last 50-60 million people is always the toughest in a vast country like US. T-Mobile has lighted up VoLTE (Voice over LTE) nationwide. Among first to debut LTE-Advanced features last year, they have been using 15 and 20 MHz wide LTE bands for deployment in many areas nationwide. T-Mobile also bought valuable 700 MHz spectrum from Verizon and is looking to aggregate their 700 MHz, 1700/2100 MHz (AWS) and 1900 MHz holdings towards providing speeds greater than 100 Mbps. Their network has been climbing up the ranks in terms of data speeds.

The option to switch providers remains an individual’s prerogative and the intent of this post is not to drive anyone towards T-Mobile. T-Mobile itself has a lot of work to do before becoming stable in the long term. But the point is that it has achieved substantial success in the US wireless business. Suitors have been coming too. After AT&T, Sprint wanted to merge with T-Mobile but the proposal was set to face regulatory hurdles. Iliad of France showed interest and Dish Network still remains a potential suitor. T-Mobile has changed the US wireless industry forever and in the process has lifted its own reputation and connection numbers. Sprint is fighting back under the new CEO, but if current trends continue, T-Mobile could surpass Sprint to take the number 3 slot in the US wireless space by early next year. A lot of credit for that must go to the man who leads this organization.

Wireless telecom infrastructure market worldwide – Trends and developments

With the proliferation of mobile technology in multiple aspects of our lives, much of the talk and analysis is about operators and consumer devices. However, playing an important role in the whole experience are the vendors who manufacture and supply the equipment behind cellular infrastructure. Many big players exist in the broader telecom space, but as with other content on this site, the focus here too will be on the wireless side. According to the telecom market intelligence firm, SNS research, the global wireless network infrastructure market stood at $52 billion last year and will remain about the same for 2014. UK-based Visiongain estimates this market to be around $47 billion. The contradiction between both reports is that while the former projects a flat or minimal growth for the wireless equipment market, the latter predicts the market to grow considerably over the next few years. I am inclined to say that this business will continue growing albeit slowly. The two reasons are LTE and LTE-Advanced roll-outs. Most operators worldwide are not investing in 2G anymore, while 3G infrastructure is still generating a substantial portion of the revenue. But the growth is all towards 4G. LTE operations and coverage are still at a nascent stage in most countries of the world. Additionally, there would always be a demand for more capacity, speed and spectral efficiency. LTE now generates half of wireless infrastructure revenue globally and according to Gartner, it will account for 80% of mobile network infrastructure spending by 2018. However, the uptick in sales would be slow as LTE growth will be at the cost of reducing 3G business and this cycle will continue with each evolving generation.

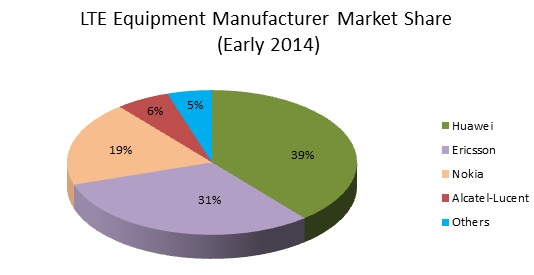

Given the importance of LTE and its advanced versions for the telecom manufacturing business, it would be worthwhile to look at the market share of top vendors worldwide. This is based on publicly available data on LTE contract commitments (fulfilled and unfulfilled) as of beginning of 2014. Most of these contracts are end-to-end covering both the radio and core aspects of LTE network.

Market share can be seen from multiple angles. The above chart only takes into account the total number of contracts and this remains the most common method of analyzing this market. While more recent LTE contract numbers are available for some manufacturers, early 2014 numbers have been used here since reliable information was available for every vendor at that timeline. Wireless network manufacturer market share can also be assessed in terms of the total worth of each of those contracts. Total subscribers served by the operators that buy the equipment from a specific vendor can be another parameter. Surprisingly, the race between Huawei, Ericsson and NSN is very close if looked in terms of end user numbers. Wireless equipment manufacturing is one of the most competitive areas of telecommunications. Here is a brief summary of each vendor’s market position –

Huawei – Shenzhen, China based Huawei is the largest telecom infrastructure manufacturer in the world. The company reported total sales revenue of $21.8 billion for the first half of this year clocking a 19% annual growth rate. They did not provide specific numbers from the wireless business for this year. At the end of 2013, its total full year revenue came in at $39.5 billion with an operating profit of $4.8 billion. The wireless revenue stood at $8.7 billion. About a quarter of this came from LTE and Huawei is striving to double its LTE revenue this year. Huawei has 290 commercial LTE contracts currently and about half of these have been deployed. It had 241 such contracts till the end of last year. Predictably, the vendors’ major customers are the 3 Chinese service providers with China Mobile being the biggest among them. Starting from the first LTE contract with TeliaSonera in 2009, Huawei has signed major LTE deals with Vodafone (for their worldwide network upgrade), EE – UK, Telenor – Norway, Etisalat – UAE, MegaFon – Russia and Softbank – Japan. It is strong in Europe, Middle East and Asia-Pacific. Huawei’s main challenge is lucrative markets like USA and India where they have not been able to enter in a big way because of security concerns.

Ericsson – Stockholm, Sweden headquartered Ericsson has been among the strongest and most stable telecom industry players globally. For the first half of 2014, the company declared sales of $14.9 billion and this was down 4% as compared to the same period last year. Network revenue stood at $7.8 billion for this time period. Bulk of network revenue came from the wireless segment although Ericsson does not provide specific numbers for the wireless side. The vendor’s full year sales for 2013 were $34.9 billion with an overall income of $2.8 billion. Network segment revenue was $18.2 billion, little more than half of the total sales (financial figures in USD could vary based on currency fluctuation). Ericsson reportedly has more than 190 LTE contracts out of which 140 have gone live. Some of their big LTE customers are Vodafone, SK Telecom – Korea, Orange – France and Verizon, AT&T – USA. Building on its existing 2G/3G relationship, it wasn’t difficult for Ericsson to grab the lucrative LTE build-out agreements with US carriers. Consequently, Ericsson’s primary source of network revenue has been North America followed by Western Europe and Northeast Asia (South Korea and Japan). Ericsson always had solid reputation as a telecom equipment manufacturer, but now faces fierce competition from Chinese players. With initial LTE deployments in US almost wrapped up, the company has witnessed slowing sales. It is now focusing more on developing markets like China and India.

Nokia (NSN) – Nokia Solutions and Networks, formerly Nokia Siemens and Networks is based in Espoo, Finland. In the January-June 2014 time frame, net sales for NSN were $7.5 billion and this was a decrease of 11% on yearly basis. The mobile broadband revenue (NSN’s terminology for wireless equipment sales) was $3.5 billion for H1 of 2014. Nokia’s reported 2013 revenue was $15.2 billion with an operating profit of $1.5 billion. The revenue from mobile broadband business unit for the year was $7.2 billion. They have 145 commercial LTE contracts currently and had 117 such contracts at the beginning of this year. NSN is considered to be the top foreign vendor in China. It won a double digit share of China Mobile’s TD-LTE contract recently. A few notable operators that are buying LTE equipment from NSN are Vodafone – New Zealand, Vimpelcom – Russia, TeliaSonera – Sweden, STC – Saudi Arabia, and T-Mobile USA. Overall, Nokia is strongest in Asia and Middle East followed by Northern Europe. After selling the handset business to Microsoft and buying out Siemens’ stake in the joint venture, Nokia’s full focus is on their networks business and they have delivered good results in the past couple of years. But the road to recovery is long as it works to dissociate itself from the mobile phone brand. Like Ericsson, aggressive price competition is hurting NSN too.

Alcatel-Lucent – Paris based Alcatel-Lucent, the owner of prestigious Bell Labs, is No. 4 in the mobile telecom infrastructure business. During the first 6 months of this year, Alcatel-Lucent reported total revenue of $8.5 billion that was down 4% as compared to the same time frame in 2013. The Wireless ‘Access’ revenue for that duration was about $3.1 billion. For the full year 2013, the total revenue was $19.9 billion with an operating income of $395 million. Wireless equipment revenue stood at $6.1 billion last year. Alcatel-Lucent’s LTE revenue grew 70% in 2013 on an annual basis. The vendor had 40 LTE contracts till early 2014 although that figure has risen to 45 recently. Alcatel-Lucent counts Verizon, AT&T and Sprint – USA, America Movil – Latin America, Telefonica – Spain and China Telecom among its top customers. It has a lot of exposure to Americas and this will have a negative impact on the company once deployments in US slow down. Alcatel-Lucent’s LTE business is growing with lots of potential opportunities, but the company as a whole is not out of the woods yet. Because of weaker financial position and a single digit market share, industry experts believe Alcatel-Lucent’s wireless portfolio if combined with Nokia, can bring rich dividends to both these companies.

Apart from the top 4, Samsung and ZTE are other smaller but growing players in the wireless equipment space. They had been mostly focused on their home markets, but have recently gained traction in other regions too. Looking at above analysis, one notices that many big telcos sell contracts to multiple vendors. Also, with total LTE subscriptions predicted to cross the billion mark in 2017, LTE is the area of growth. Operators in USA, South Korea and Japan are already deploying LTE-Advanced and this is the next big opportunity. All players are refining their small cell and VoLTE strategies. They are also looking to reduce the complexities of base stations. This will make the vendor battles even more interesting. Keep watching this space for more updates on mobile telecom equipment supplier market.

The 600 MHz Incentive Auction in US – What we know so far

A major high stakes wireless industry event generating a lot of interest nowadays in US is the 600 MHz incentive auction for broadcast spectrum scheduled to take place in 2015. This auction assumes special significance since it would be perhaps the last set of airwaves under 1 GHz that will be sold in America through a primary auction. Given the exploding demand for data on mobile devices and the superior propagation characteristics of wireless signals in this band, the four major US carriers – Verizon, AT&T, Sprint, T-Mobile and many smaller regional service providers have exhibited deep interest in this spectrum. The proposition is considered a first of its kind in the world. To put it simply, the broadcasters will voluntarily sell their spectrum to the US regulator, FCC through a reverse auction. Subsequently, the mobile operators would buy those airwaves through traditional bidding. But the reality will be more complex than that and this article would attempt to address the related complexities.

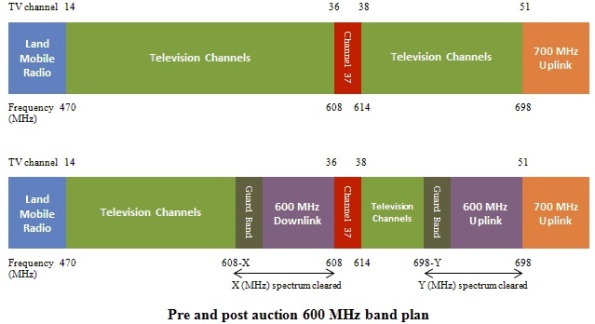

The FCC first floated the idea of utilizing broadcast TV airwaves for mobile broadband access in the National Broadband Plan of 2010. Two years later, the US Congress authorized the Commission to conduct the incentive auction of the broadcast television spectrum. In the fall of 2012, the FCC issued a Notice of Proposed Rulemaking (NPRM) to officially kick off the rules and guidelines developing process for the 600 MHz auction. The following diagrams illustrate the concept of this auction in terms of how the television broadcast spectrum looks currently and one of the several proposals on what it could look like after the completion of this auction.

The values of X and Y as shown above, are variable and obviously depend on the amount of spectrum that the broadcasters are willing to sell. One of the ideas floated by the FCC is the provision to accommodate different amount of TV spectrum relinquished in different markets. The downlink spectrum would be a fixed band nationwide while the uplink band may vary depending on the market. The FCC is hoping that 120 MHz of total spectrum can be made available through this process although the actual figure would be less than this and will be determined by the willingness of TV station owners to give up their usage rights. The first aspect of these incentive auctions would be the reverse auction. Over-the-air active TV licensees holding 6 MHz spectrum in various areas of US will be eligible to participate in the reverse auction. In order to ensure maximum participation, the NPRM states that such licensees would have 3 options. They could either give up the Ultra-High frequency (UHF) channel and relocate to a channel in the Very High Frequency (VHF) range or give up their channel and share a broadcast channel with another licensee post-auction or they can simply sell all their rights to the channel and go off air. In every case, the selling broadcaster could potentially earn tens or in some cases hundreds of millions of dollars in exchange of the spectrum rights in a region. The second aspect would be repacking those broadcast channels that did not participate in this auction and will be on air after the whole process ends. This will ensure that such stations occupy one end of the spectrum resulting in contiguous blocks that could be sold off to the wireless network operators. During the rebanding, the channels would be reassigned and not geographically relocated. There would be no negative impact on the coverage area and served population of a TV station. Final piece of the puzzle would be the forward auction, a process that is generally followed to sell airwaves to the telcos. However, the regulator may follow a new approach to this process, since different areas might open up different amounts of spectrum. Selling spectrum in blocks and keeping flexible uplink spectrum are two such approaches. The pricing of airwaves in a particular region would depend on the success of reverse auction in that region. Another important aspect of the 600 MHz incentive auctions would be the integration of reverse and forward auctions. Both could either run sequentially or concurrently. The sequential path would show the supply through reverse auction to the bidders, but the sellers would be unable to determine the right price, since they would not be aware of the demand during the forward bidding. The concurrent path would show the supply demand balance, but how would repacking fit into that plan?

It is quite obvious that many questions need to be answered before marking a date for this auction. Biggest of them is whether the broadcasters would volunteer to relinquish their spectrum rights. The National Association of Broadcasters (NAB) has shown cautious interest in the auction. They are unsure about the kind of money that can be earned by either exiting the business or going to a shared channel. In comments filed with the Commission last summer, they also expressed deep concern over the co-existence of broadcast and mobile carriers on co-channels and adjacent channels in neighboring markets. They endorsed a nationwide standard band plan rather than an area-dependent approach that maximizes spectrum recovery. The NAB is definitely looking for more transparency in the rules. The FCC itself is still not sure about the success of the auction. The procedure can go belly up right at the start if participation from the broadcasters is low. Remember, if the target is to free up 120 MHz of frequencies, 20 stations will be required to exit the spectrum. Repacking presents another conundrum. Any move to reconfigure the TV stations would be complex and dependent on multiple factors. Apart from time and cost of repacking, interference protection on the new channel would be a major concern. There is no dearth of controversies on the wireless operator side too regarding these auctions. Bigger carriers like AT&T and Verizon want an open and simple bidding mechanism with no spectrum caps. Sprint, T-Mobile and other smaller rural carriers want an upper limit on the amount of airwaves that a bidder can buy. They claim that AT&T and Verizon already control more than three-fourth of commercial wireless spectrum below 1 GHz. Thus such a limit would promote consumer interest and encourage competition. Nonetheless, restrictions on spectrum bidding would reduce government’s revenue. There are divergent views on the channel block size and the size of economic areas (EA) too, although the spectrum is likely to be auctioned off in 5 MHz blocks. Appropriate utilization of the guard band frequencies is one more contentious topic. Internet companies like Google and Microsoft want unlicensed operations in that band, while the mobile telcos support only limited unlicensed spectrum. Given so many unresolved problems, the FCC delayed the 600 MHz incentive auctions until middle of 2015.

The regulator clearly needs to address issues of all stakeholders, but to be fair, this is an unprecedented situation and it is important to get it right even if that requires more time and discussion. The original plan was to have the order for this unique auction out by this spring, but that looks improbable now. The regulator must assuage the concerns of broadcasters in the order. Rules and guidelines must be transparent with a well-defined structure. The barriers to entry must be low and TV spectrum owners should be educated about the approximate amount of dollars that they can expect in exchange of their 6 MHz of spectrum. They must be encouraged to explore the channel sharing option too. A recent pilot project conducted by 2 stations in Los Angeles concluded that sharing the same broadcast spectrum is technically feasible. Also as part of the order, the repacking methodology must be clearly laid out with specific timelines and costs involved. Various technical parameters like interference protection should also be outlined. Broadcasters must be assured that repacking will not affect their services in any manner and to further convince them, they should be allowed to test the repacking model. The station owners should be made to understand that since less than 10% of US households completely rely on over-the-air television, the spectrum they are holding can be utilized more efficiently if allocated for wireless data services. The other key policy challenge is on the forward auction side. There are valid arguments both in favor of and against imposing restrictions on spectrum that be bought by a bidder, so a balance has to be struck to ensure maximum participation and a level playing field. Lastly, the software and systems have to be extensively tested before commencing the complicated process.

There is clearly a long road to travel before these auctions can be held. There have been some positive developments like the formation of Expanding Opportunities for Broadcasters Coalition (EOBC). EOBC represents broadcasters that are interested in these auctions and want to be a part of the rulemaking process in order to make this endeavor a success. But much more needs to happen. A well-designed competitive sale process encompassing all three stages is what the industry needs and if executed well, it can bring rich benefits to the consumers, promote competition and boost the economy. A successful auction would also influence other nations to follow suit. Now there is only shot at getting it right. The FCC seems to be working hard at it and basic idea sounds good, so let us hope for a result that is in best interests of all the stakeholders.

A comparison of iPhone 5S pricing across the globe

In some of the Apple oriented conversations over the past few years with friends, I have often wondered whether the iPhone would have been so popular in the US if it was sold only unlocked and without contract. With a 2 year carrier contract, the 16 GB version of this phone costs about $216 ($199 + taxes). However the same iPhone unlocked would cost $702 ($649 + taxes). These prices could vary slightly from city to city in USA depending on sales tax. Personally, I am not a fan of the 2 year contract, but it is not a bad deal if it saves those hundreds of dollars.

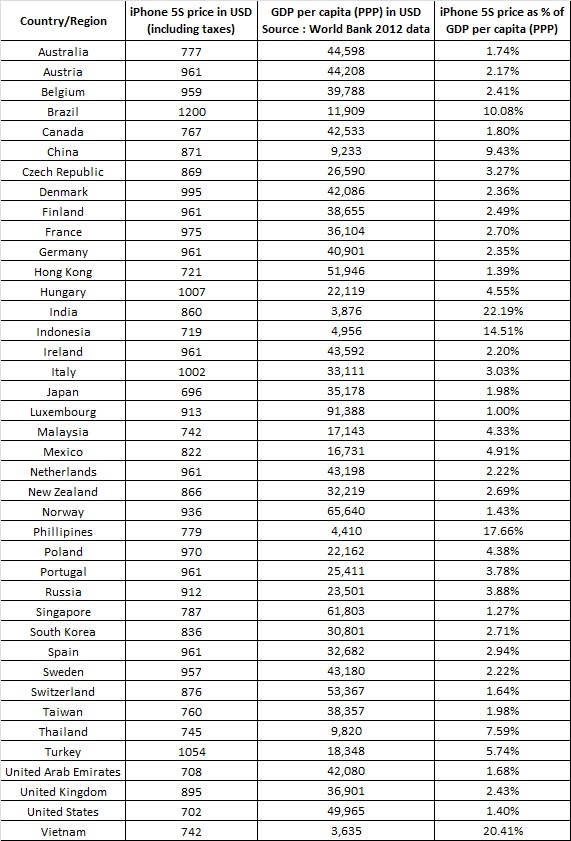

With Apple making iPhone available in more and more geographies every year, it is worthwhile to look at the price of this phone in different countries. Remember, iPhones are sold unlocked in most countries, hence are expensive. The reasons for the varying cost of the same device across different nations could be many like taxes, local policies, number of intermediate distribution channels, transit cost etc. Now absolute iPhone pricing is misleading and tells only the story on the surface. Since $700 in US is not the same as $700 in let us say Spain or China even after currency conversion, it is important to look at the value of a dollar in those countries for an in-depth understanding of this aspect. Taking into account the Gross Domestic Product (GDP) per capita based on Purchasing Power Parity (PPP) is one measure to look at such analysis. PPP is a reliable number to compare economic strength between countries, since it considers important statistics like inflation and cost of living. In this blog post, the above economic figure has been taken from the World Bank’s 2012 data. The following table covers all countries (in alphabetical order) where an online Apple store is functional. Apple has separate pricing for Taiwan and Hong Kong, so they are treated separately here too. Although the company does not sell online directly in India, I brought in numbers for the country since India has been a primary region of focus of this blog along with USA. Prices in the 2nd column are for the 16 GB unlocked version of the phone.

For further analysis, the excel spreadsheet can be downloaded here: iPhone 5S pricing comparison

A close look at the table reveals that within the 40 countries analyzed above, iPhone is the cheapest in US and Japan and the most expensive in Brazil and Turkey. But probably it is easiest on the pocket in Luxembourg and Singapore and conversely weighs heavy on the pocket in India and Vietnam. Before drawing any conclusive arguments, a few observations must be mentioned here. First, this article enlists the iPhone 5S dollar figures based on multiple currency exchange rates as of this writing. That could change on a daily basis. Second, the GDP per capita PPP numbers could differ depending on the source. The economic data has been taken from the World Bank, but if taken from the International Monetary Fund (IMF), it would vary. Third, the precise calculation of the strain on the wallet of any customer in a particular nation could depend on many other factors, since Apple targets different income segments in different regions. Lastly, these are only 20% of the countries in the world. While it is unlikely that an unlocked iPhone is cheaper than $650 in any region, it could cost much more than $1000 in some regions. These numbers are neither absolute nor final, but they are a good indicator of what it might mean financially to buy an iPhone in these countries.

Why USA is the leader of advanced wireless services and Europe has fallen behind?

Europe had been a pioneer of innovation and deployment in wireless communications for a dominant period in the history of this technology. From the first GSM standard to the first LTE network in Scandinavia, Europe led all the way. Till about 6 years ago, the European wireless market was at par or even better than the American market in certain aspects. But the scenario is changing now with the United States taking over as the leader of next-generation wireless services. Here are a couple of quick statistics to support this view. The GSM Association’s recent report estimated that 19% wireless connections in US would be on LTE by year end compared with 2% in the European Union. Wireless capital expenditure (CAPEX) has declined slightly in Europe over the past 6 years but has shot up more than 70% in US over the same period of time. While it is somewhat unfair to compare the whole continent with a single country, most of Europe has moved together when it comes to telecommunications. Many nations have common wireless operators who face similar challenges.

Let us first look at how USA became the frontrunner of the global mobile telecom industry. Avid telecom followers would remember that US was considered late to the 3G party. Till about 2007, 3G adoption in US was slow and only a few business users were tempted by the need to access data on their phones. Blackberry was considered the best in the industry. Mass market tablets were non-existent. All that started to change with the launch of the first Apple iPhone in mid-2007. Data usage exploded. With AT&T being the sole carrier of the device till early 2011, its data uptake shot up 8000% in 4 years. Accessing Facebook, GPS, sports scores, news, travel websites, restaurant reviews etc. while on the move became the cool thing. Google followed Apple with its open source Android operating system. By 2009, the market was flooded with Android powered phones from Samsung, HTC and Motorola. Apart from AT&T, Verizon, Sprint and T-Mobile jumped aboard the Android bandwagon and also started noticing a sharp rise in data hungry customers. To attract more subscribers initially, all of them offered unlimited data plans. Although data brought in additional revenue, the cost of offering data per bit was going up because of the additional capital and operational expenditure. The initial reaction was to boost network speeds in existing 3G networks. Thus, HSPA and HSPA+ (also referred to as 3.5G) technologies were deployed by AT&T and T-Mobile. Verizon Wireless had a different predicament. Their 3G version, EVDO Rev. A, topped out between download speeds of 3 and 4 Mbps in normal traffic conditions. This was slower than the WCDMA and HSPA data speeds provided by other operators. Given this constraint and the exploding smartphone market, Verizon’s best option was to embrace the next generation LTE technology. Timely auction of the 700 MHz spectrum in 2008 acted as a booster. After launching their first LTE network in December 2010, the operator rapidly deployed the technology all over US and now covers most areas of the country. Sprint put its money on WiMAX initially, but realized in a few years that LTE is the future and finally launched LTE last year. Despite being hammered by data demand from millions of iPhones, AT&T Wireless took its time to jump on to LTE. Their first LTE network came into operation 2 years ago. T-Mobile decided to squeeze the most juice out of its HSPA+ networks and launched LTE in March this year. All 4 carriers have LTE-Advanced on their roadmap in 2-3 years. Telcos have essentially learned the importance of both ‘first to market’ and ‘best to market.’ Subsidized handset availability served as another catalyst for the smartphone revolution in US. Personally, I am not a fan of 2 year service agreement with the provider, but it does make that latest phone more affordable. Increasing smartphone usage pushed the service providers towards LTE. The traditionally expensive cellphone service in US (with ARPUs among the highest in the world) played a major role in keeping the industry booming. And while customers want lower bills, they want faster speeds and increased capacity too. A direct implication of this approach is the quality of service in US that is widely considered to be among the best in the world.

A healthy, stable and encouraging regulatory environment goes a long way in deciding the quality of telecommunication services. The US regulator FCC and the government prioritized opening of more spectrum in order to promote advanced wireless services deployment all over the country. Mergers and acquisitions have also acted as shot in the arm for the industry. Japanese operator, Softbank acquired 80% of Sprint and Sprint completely acquired Clearwire. T-Mobile merged with MetroPCS and AT&T bought Leap Wireless. While smaller and local service providers still remain in operation, the recent M&A activity has made sure that 4 well-financed, stable and competitive service providers remain in the US industry.

Europe’s lackluster performance in the field of cutting-edge wireless technologies can be attributed to various factors. The recent financial meltdown across the continent gets part of the blame. While the American economy has substantially recovered, Europe has seen a prolonged economic struggle. Sovereign debt crisis and lack of faith in Euro have affected the growth and competitiveness across the continent in the past few years. Needless to say, the telecom sector has been adversely affected. Telcos have become risk averse and CAPEX in fresh wireless infrastructure like LTE has been sluggish. Bitter experiences of the past have also prevented large scale investments from the European telecom firms. Around the turn of the century at the height of tech bubble, many of them spent billions of dollars in buying 3G spectrum and in developing infrastructure for the technology. It left them with huge debts and telcos are still milking their 3G assets to recover that investment. Vodafone CEO Vittorio Colao called the 3G auctions in UK (in the year 2000) an aberration, that was not going to repeat itself. That auction raised about $35 billion for the government, while the 4G auction earlier this year in UK fetched only 10% of that, an amount much more reasonable and affordable for the bidders. Similarly, Germany raised a staggering $67 billion from their 3G auction, but the 4G airwaves fetched only $5.5 billion in 2010. The lesson had been learned and repeating the same mistake with LTE and 4G would have been suicidal. In fact, the Czech regulator canceled fourth generation spectrum auction earlier this year, since the high bids would have hampered the operator’s finances with the costs being passed on to the customer. The auction will be held again later this year and the idea is to encourage new players to enter the market.

Higher competition and lack of consolidation is another impediment. Europe has more than 100 mobile service providers spread across various regions but the European Commission’s antitrust policies have kept the market fragmented. Direct consequence of high competition is the lower ARPU. The GSMA report estimated the 2012 ARPU in Europe to be $38 as compared to $69 in US. The more money a service provider makes, the more it will invest in the latest technology. Consolidation brings in economies of scale. It must also be noted that many European governments have awarded airwaves for LTE services, but the telcos are taking their own time in bringing up LTE since the data market is still developing. This brings us to the discussion on consumer appetite. In my personal experience and I am sure many would agree, the mobile subscribers in US are hooked to their smartphones more than people from any other country. According to various estimates, they use five times more voice minutes and twice as much data compared to their European counterparts. This ties into the ARPU numbers mentioned earlier in this post. The telecom crash of early-2000s has surely taught the industry that if the demand is rising only slowly, where is the need to hurry on the infrastructure? Fragmented spectrum across various nations has exacerbated the operator’s troubles too. Telecom companies like Vodafone, Orange, T-Mobile and Telefonica provide mobile services in many areas and they would very much like a harmonized spectrum approach. The European Commission’s attempt to make 800 MHz the digital dividend spectrum across all EU member nations by this year is good in theory but difficult in implementation. It has been met with only limited success with many countries expressing inability to meet that policy requirement.

According to a Cisco report, wireless data speeds in US are on an average 75% faster than the corresponding speeds in the EU. In my recent travels across Europe, speed tests showed download speeds ranging anywhere from 1 to 5 Mbps depending on the country. These were essentially 3G and HSPA network speeds. Due to lack of LTE roaming, I could not experience the LTE speeds in Europe. Interacting with fellow telecom professionals in the continent, I was convinced that Europe has been slow to embrace LTE, although LTE deployment is now picking up pace in some European countries. One could argue that why compare a single country, US with the whole continent? And does it really matter, if consumers are not complaining? There is some logic to these arguments. But Europe can learn from America’s telecom industry. The European Commission has been sending encouraging signals towards introducing industry friendly reforms. If the merger of Telefonica’s O2 with the Dutch company KPN’s E-Plus in Germany is approved, it could set the tone for further M&As across Europe. Earlier this year, the continent’s telecom commission expressed willingness to create a unified telecoms market across Europe in order to foster cross border harmonization of the industry’s policies and spectrum. Any such move could face stiff resistance from different quarters with operators having diverse viewpoints especially on issues like free roaming. But where they do agree is that investing in LTE will keep the European economy globally competitive. Only time will tell how fast they can catch up with not just US, but also with other LTE leaders like South Korea and Japan. Maybe they will lead again once 5G comes along?

Tracking the progress of LTE in Asia

About a year ago, I wrote a blog post about LTE developments across Europe. In the current article, the focus would be on Asia, the continent that is home to 60% of the world’s population. The dynamics of the telecom market in Asia are different from those in US and Europe. Most countries are developing economies where the majority of revenue still comes from voice. Much of the mobile market is untapped and even voice penetration is nowhere near 100% in most Asian nations. But contrast is noticeable all over the continent. On one hand, there is South Korea that leads the world in implementation of mobile technologies like LTE-Advanced, and on the other hand there is Myanmar where mobile penetration remains extremely low and market liberalization is a recent phenomenon. 3G is still in developmental stages and LTE is a far-fetched dream in many countries. Consequently, the average customer is not yet addicted to his/her smartphone or tablet.

In order to discuss the progress of LTE in Asia, I have focused on 10 most populous nations in the continent that either already have or will soon have at least one operational LTE network. So if a highly populated country in Asia does not feature in this status update, that’s because it has not gained much LTE momentum yet. LTE progress will be tracked on 3 parameters – Deployment timelines, spectrum and LTE flavor (FDD or TDD).

China – The world’s biggest operator by subscriber count, China Mobile is deploying LTE TDD primarily in the 2.6 GHz band and a full scale commercial launch is expected later in 2013. In some areas, 1900 MHz and 2.3 GHz frequencies will also be utilized by the operator. For the past 2 years, technology trials have been run in various cities. The initial launch is expected to cover about 500 million people in some 100 cities. The country’s next two big telcos, China Unicom and China Telecom are still testing LTE with no fixed time frame yet for commercial rollout. Both are aiming for a hybrid FDD-TDD LTE network with 1800 MHz and 2.1 GHz expected to be the spectrum for the FDD form.

Hong Kong saw its first LTE network in November 2010 deployed by CSL Limited in 1800 MHz and 2.6 GHz bands. Two other mobile service proivders in Hong Kong, PCCW and Hutchinson 3, launched LTE in May 2012 under the ‘Genius’ brand using the same frequencies. SmarTone announced LTE service in August last year in the 1800 MHz band. All these networks are FDD. China Mobile Hong Kong started LTE FDD service in April 2012 in the 2.6 GHz band. That was followed by LTE TDD service in December 2012 in the 2.3 GHz band.

India – World’s second largest mobile market by subscribers saw its first LTE network in TDD form launched by Bharti Airtel in the 2.3 GHz band in April 2012. This mobile broadband LTE service is so far available in 4 cities – Kolkata, Bangalore, Pune and Chandigarh, although Delhi and Mumbai are expected to join that group in the next few months. Reliance Jio Infocomm is the only Indian operator which has nationwide BWA licenses in 2.3 GHz band. It intends to launch LTE TDD network in select cities next year. Tikona Digital Networks is looking to rollout a similar LTE service in the same band in early 2014 in 5 circles (telecom zones). Aircel won BWA (2.3 GHz) licenses in 8 circles but the company is heavily under debt. Unconfirmed reports stated earlier this year that the telco might sell its BWA licenses. Videocon has announced plans to deploy LTE FDD in 1800 MHz by next year in 6 circles. It could be the only Indian cellular service provider whose LTE service is more aligned with many other operators in the world. India’s adoption of LTE will be slow, since 3G has only recently gained some real momentum.

Japan – Japan’s NTT DoCoMo was an early adopter of LTE when it started offering the technology to its customers in December 2010. NTT uses LTE FDD in the 2.1 GHz band and reached 15 million LTE subscribers in the recent past. Last year, the service provider added LTE capacity in the 1500 MHz band. KDDI’s LTE FDD service under their ‘au’ brand went commercial in September 2012 in the 2.1 GHz band. They added 800 MHz and 1500 MHz frequencies in November that year. Softbank, the No. 3 mobile service provider of Japan, launched LTE TDD in 2.5 GHz band in February 2012. Then in last September, the FDD version was launched in the 2.1 GHz band. Softbank’s eMobile brand has an LTE FDD service since March 2012 in 1800 MHz band. All Japanese telcos are also looking to utilize frequencies in the 700 MHz range for LTE services by 2015.

Philippines – Smart Communications commenced full scale LTE service in the Philippines in August 2012. Initial deployment was done in the 2.1 GHz band but later that year, the network added 850 MHz and 1800 MHz bands. The service has been extended to about 115 cities in the country. Another provider, Globe Telecom launched its LTE network in September 2012 in the 1800 MHz band. Both service providers have used the FDD version.

Thailand – Thailand’s first LTE network was launched in May this year by True Move H using FDD in the 2.1 GHz band. That remains the only operational LTE deployment in the country so far. Network partners TOT & AIS are expected to rollout LTE TDD service this year in the 2.3 GHz band for mobile broadband customers. DTAC and CAT Telecom are two other Thai operators that are looking to deploy LTE FDD in the 1800 MHz band with no defined timeline for a commercial launch.

South Korea – Korea’s SK Telecom has been a harbinger of LTE technology. Their first LTE network went into operation in July 2011. 850 MHz frequencies were used for this service which went nationwide by April 2012. Femtocells were added to the network in December 2011, making it one of the first heterogeneous networks in the world. Thereafter in another global first, VoLTE was launched by SK Telecom about a year ago and the operator notched up about 4.5 million VoLTE subscribers in 11 months. The telco also deployed Carrier Aggregation, an LTE-Advanced feature, on their network in June 2013. 10 MHz spectrum each from 850 MHz and 1800 MHz bands was combined to create an effective bandwidth of 20 MHz. Another Korean service provider, LG Uplus launched a similar LTE service simultaneously with SK Telecom in the same band. They again matched SK Telecom’s calendar for nationwide LTE and VoLTE rollout. A couple of months ago, LG U+ also started using 2.1 GHz spectrum for LTE and combined it with 800 MHz airwaves to enable Carrier Aggregation. Both SK Telecom and LG U+ will be deploying more LTE-Advanced features like CoMP and eICIC in 2014. (For more on these technologies, look at this post). Not to be left behind, the country’s third big telco, KT rolled out LTE in January last year using the 1800 MHz band. Recently, KT also started employing 900 MHz spectrum for LTE. With the service provider acquiring another chunk of airwaves in the 1800 MHz band in a recent auction, it announced the capability to provide LTE-Advanced this month. All Korean deployments have used LTE FDD.

Iraq – Despite all the troubles that Iraq has faced in the recent past, the country has made progress in telecommunications. Regional Telecom launched the country’s first LTE FDD service in the 2.6 GHz band in June 2013 under the Fastlink brand for mobile broadband subscribers. MaxyTel in Iraq has been in planning stages of an LTE TDD network.

Malaysia – Many service providers in Malaysia have launched LTE services in 2013 in the 2.6 GHz band using FDD. Maxis/REDTone did it in January, Celcom/Axiata in April, and DiGi launched it in July. In April 2013, Maxis and Celcom added 1800 MHz spectrum to their LTE networks. Packet One and Asiaspace are two WiMAX mobile broadband operators in 2.3 GHz that are planning to convert to LTE TDD. U Mobile is another Malaysian operator looking to launch LTE FDD later this year in the 2.6 GHz band.

Uzbekistan – MTS commenced LTE service in Uzbekistan in July 2010 but the company later went bankrupt. TeliaSonera’s UCell rolled out LTE FDD in the 700 MHz and 2.6 GHz bands in August 2010. Another telco, Unitel under the Beeline brand, has been testing the same technology in 2.6 GHz band since February 2012 although not much information is available about a market launch.

Saudi Arabia – Three major Saudi operators simultaneously launched LTE in September 2011. Etisalat’s Mobily deployed LTE TDD network in the 2.6 GHz band. Saudi Telecom Company (STC) deployed 2.3 GHz spectrum for the same service. In February this year, the operator commenced LTE FDD service in the 1800 MHz band. Zain Saudi Arabia launched LTE FDD in the 2.6 GHz band in September 2011 and added 1800 MHz spectrum to the service in June 2012.

Many other Asian countries have made impressive strides in LTE deployments. But it was not possible to discuss all such countries in one post, thus only 10 of them have been covered. Looking at the analysis above, it is obvious that multiple spectrum bands have been used although 1800 MHz and 2.6 GHz are the most popular ones. The time division form of LTE is popular in Asia more than any other continent. LTE device ecosystem is still in nascent stages in Asia and that prevents the full scale use of this technology. There are many nations yet to jump on the LTE bandwagon, but by the end of the decade, most mobile wireless communications would be happening over LTE networks not just in Asia, but all over the world.

LTE Advanced – Key features and differentiators

As a wireless technology, LTE is still in early stages of deployment in various countries outside US. But that has not prevented the wireless operators from talking about its next version, LTE Advanced (LTE-A). Technology Inflation has become the nature of wireless industry. The next big thing is always around the corner. In their attempt to lure customers away from their competitors, many service providers love to declare their adoption of the latest and fastest wireless standard. As long as this latest technology presents a substantial data rate improvement over the previous version, it is labeled as a new generation. This is also what is happening with LTE Advanced. A superior form of the already velocious LTE, some call it the actual 4G. For others it could be 4.5G. Without getting into the generation debate, I will keep referring to this technology as LTE Advanced throughout this article. According to the 3GPP group, LTE-A networks should support a downlink data speed of 3 Gbps and uplink speed of 1.5 Gbps. Let us understand the primary features of LTE Advanced that would propel LTE towards achieving those speeds. Most of these were formalized as part of 3GPP Release 10 –

- Carrier Aggregation – One of the most popular aspects of LTE-A is that it allows a combination of up to five component carriers of varying bandwidth to aggregate and form a cumulative bandwidth of maximum 100 MHz. In comparison, contemporary LTE networks support only a single channel with a maximum bandwidth of 20 MHz. Carrier aggregation can be achieved within the same band using contiguous or non-contiguous stream of channels or between channels from two different bands. It offers an ideal solution to operators who do not own a contiguous chunk of 100 MHz spectrum. The technique can be applied to both FDD and TDD versions of LTE. Carrier aggregation will perhaps be the first attribute of LTE Advanced that goes into live action. For more details on carrier aggregation, refer to an earlier article on this blog here.

- Higher order MIMO – Multiple Input Multiple Output (MIMO) increases the bitrate by using multiple transmission and receiver antennas. While LTE can support 4×4 MIMO configuration with 2×2 being the most common, LTE-A will have the capability to run 8×8 configurations in downlink and 4×4 in the uplink. Higher order MIMO directly improves spectral efficiency and throughput. Theoretically, 8 spatial streams can achieve speeds which are about 8x faster than a single input single output system.

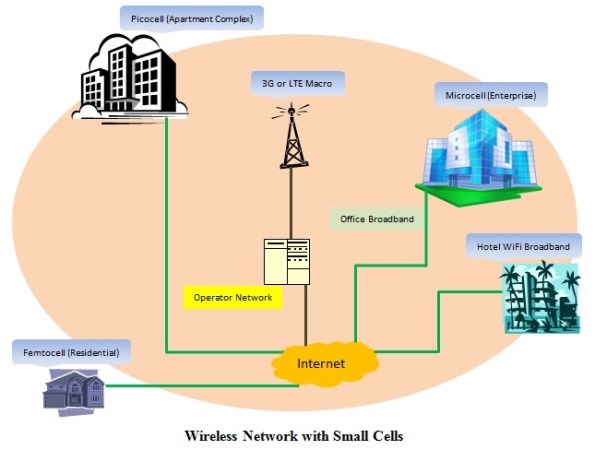

- Relay nodes and Heterogeneous networks – Relay nodes are deployed to provide better coverage and capacity at cell edges. Such nodes are low power base stations that act as repeaters to enhance the signal quality and rebroadcast the signal. They connect with eNodeB via wireless interface and offer substantial cost savings as compared to a new eNodeB installation. The concept of relay nodes directly ties into the idea of a heterogeneous network (HetNet). As I discussed here, HetNets enable wireless networks of varying cell sizes, output power and radio access technologies to work together towards the goal of boosting network coverage and capacity. With many wireless operators believing that small cells would be an essential part of their future strategy, there is a big industry push towards HetNets. LTE Advanced will further drive the deployment and adoption of heterogeneous networks.

- Enhanced Inter-Cell Interference Coordination – eICIC will be the primary interference management and mitigation procedure adopted in the LTE-A network. It is typically used in a heterogeneous network where both macro and pico cells transmit and receive data at the same time. The weaker signal from the smaller cell can be easily overpowered by the stronger signal from the larger cell. In eICIC, certain subframes are transmitted by the macro cell without any data. These almost blank subframes (ABS) are low power control channels. The users in the pico cell area then communicate with their base station during such blank subframes. This minimizes the interference between the macro and pico cell on both traffic and control channels. Advanced interference mitigation schemes have been used in LTE networks, but with the increasingly high density of wireless network cells, more sophisticated schemes like eICIC are required.

- Coordinated Multipoint (CoMP) Transmission – Formalized in 3GPP Release 11, CoMP would be another key characteristic of a true LTE Advanced network. In a Coordinated multipoint transmission and reception scenario, multiple eNodeBs work with each other dynamically to avoid interference with other transmission signals. This leads to a better utilization of system resources and an enhancement of both network coverage and quality for cell edge users.

Above five functionalities are generally considered to be the vital differentiating factors which will separate LTE-A from its predecessors. There are plenty of other evolutionary technology proposals which have been suggested for LTE-A. Here are some of them –

- Enhanced Self-Organizing Networks – SONs are self-configuring, optimizing and healing mobile networks. As the name suggests, self-configuration applies to newly deployed eNodeBs, self-optimization is performed by active base stations to regulate parameters in synchronization with the overall network situation and self-healing features automatic detection and compensation of network outages. The concept of SONs will be implemented in LTE Advanced networks.

- Further Evolved Multimedia Broadcast Multicast Control – eMBMS ensures an economical mechanism for the operator to deliver broadcast and multicast services. First defined for LTE, eMBMS has been further refined and enhanced for LTE Advanced. It offers more carrier configuration flexibility, higher video resolution services because of higher LTE bit rates and a dynamic reservation/release of network resources.

- Cognitive Radio – Cognitive radios are designed to understand their environment and modify their own parameters like frequency, power, and modulation in such a way so as to utilize the unused spectrum dynamically in order to maximize spectral efficiency and minimize interference. While not explicitly defined within the LTE-A proposals, cognitive radios have been a prime area of interest for such networks because they can solve the spectrum scarcity problem.

One has to take into account that a real LTE-A network could have many more cutting-edge attributes and not every LTE Advanced network will sport all the above features. LTE-A is actually a collection of technologies. Consequently, we have to be careful about the marketing strategies that the network operators will follow. They could implement just one or two of above technologies and called their network LTE Advanced as long as it doubles or triples the current data rates. Few operators already claim that they are on the path to LTE Advanced. Last fall, Russian service provider Yota announced the world’s first LTE-A in Moscow with speeds up to 300 Mbps on consumer devices. Of course there are no LTE-A capable devices available yet. Korea’s SK Telecom has recently advertised its plans to launch LTE Advanced network by September of this year. They claim to have applied carrier aggregation, CoMP, femtocells and self-organizing network capability to their network. In US, T-Mobile has been happily declaring that since they were last to the LTE party and thus have the latest hardware, their transition to LTE-A would be faster and smoother. AT&T, Verizon and Sprint have been deploying small cells and advanced MIMO as part of their future LTE Advanced strategy. China Mobile and Vodafone New Zealand have tested the technology while achieving peak downlink speeds of 300 Mbps. Australia’s Telstra is also using carrier aggregation to launch LTE-A services later this year. Hardware manufacturers are not far behind. Qualcomm, Broadcom, Agilent, Ericsson and many others are already out with their LTE Advanced capable chipsets and network equipment.

Again, all above claims must be taken with a grain of salt. Wireless service providers are in a tightly competitive market and it is their business to tout the deployment of state of the art technologies. But it is for the consumers to decide that how much speed is good enough for them. Industry analysts like us can help them in separating truth from hype. Yes, LTE Advanced, whenever it gets here would be very awesome, but will not arrive in its true form before 2015.