Archive

The 600 MHz Incentive Auction in US – What we know so far

A major high stakes wireless industry event generating a lot of interest nowadays in US is the 600 MHz incentive auction for broadcast spectrum scheduled to take place in 2015. This auction assumes special significance since it would be perhaps the last set of airwaves under 1 GHz that will be sold in America through a primary auction. Given the exploding demand for data on mobile devices and the superior propagation characteristics of wireless signals in this band, the four major US carriers – Verizon, AT&T, Sprint, T-Mobile and many smaller regional service providers have exhibited deep interest in this spectrum. The proposition is considered a first of its kind in the world. To put it simply, the broadcasters will voluntarily sell their spectrum to the US regulator, FCC through a reverse auction. Subsequently, the mobile operators would buy those airwaves through traditional bidding. But the reality will be more complex than that and this article would attempt to address the related complexities.

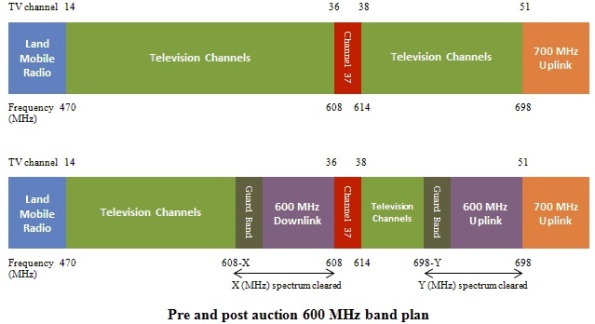

The FCC first floated the idea of utilizing broadcast TV airwaves for mobile broadband access in the National Broadband Plan of 2010. Two years later, the US Congress authorized the Commission to conduct the incentive auction of the broadcast television spectrum. In the fall of 2012, the FCC issued a Notice of Proposed Rulemaking (NPRM) to officially kick off the rules and guidelines developing process for the 600 MHz auction. The following diagrams illustrate the concept of this auction in terms of how the television broadcast spectrum looks currently and one of the several proposals on what it could look like after the completion of this auction.

The values of X and Y as shown above, are variable and obviously depend on the amount of spectrum that the broadcasters are willing to sell. One of the ideas floated by the FCC is the provision to accommodate different amount of TV spectrum relinquished in different markets. The downlink spectrum would be a fixed band nationwide while the uplink band may vary depending on the market. The FCC is hoping that 120 MHz of total spectrum can be made available through this process although the actual figure would be less than this and will be determined by the willingness of TV station owners to give up their usage rights. The first aspect of these incentive auctions would be the reverse auction. Over-the-air active TV licensees holding 6 MHz spectrum in various areas of US will be eligible to participate in the reverse auction. In order to ensure maximum participation, the NPRM states that such licensees would have 3 options. They could either give up the Ultra-High frequency (UHF) channel and relocate to a channel in the Very High Frequency (VHF) range or give up their channel and share a broadcast channel with another licensee post-auction or they can simply sell all their rights to the channel and go off air. In every case, the selling broadcaster could potentially earn tens or in some cases hundreds of millions of dollars in exchange of the spectrum rights in a region. The second aspect would be repacking those broadcast channels that did not participate in this auction and will be on air after the whole process ends. This will ensure that such stations occupy one end of the spectrum resulting in contiguous blocks that could be sold off to the wireless network operators. During the rebanding, the channels would be reassigned and not geographically relocated. There would be no negative impact on the coverage area and served population of a TV station. Final piece of the puzzle would be the forward auction, a process that is generally followed to sell airwaves to the telcos. However, the regulator may follow a new approach to this process, since different areas might open up different amounts of spectrum. Selling spectrum in blocks and keeping flexible uplink spectrum are two such approaches. The pricing of airwaves in a particular region would depend on the success of reverse auction in that region. Another important aspect of the 600 MHz incentive auctions would be the integration of reverse and forward auctions. Both could either run sequentially or concurrently. The sequential path would show the supply through reverse auction to the bidders, but the sellers would be unable to determine the right price, since they would not be aware of the demand during the forward bidding. The concurrent path would show the supply demand balance, but how would repacking fit into that plan?

It is quite obvious that many questions need to be answered before marking a date for this auction. Biggest of them is whether the broadcasters would volunteer to relinquish their spectrum rights. The National Association of Broadcasters (NAB) has shown cautious interest in the auction. They are unsure about the kind of money that can be earned by either exiting the business or going to a shared channel. In comments filed with the Commission last summer, they also expressed deep concern over the co-existence of broadcast and mobile carriers on co-channels and adjacent channels in neighboring markets. They endorsed a nationwide standard band plan rather than an area-dependent approach that maximizes spectrum recovery. The NAB is definitely looking for more transparency in the rules. The FCC itself is still not sure about the success of the auction. The procedure can go belly up right at the start if participation from the broadcasters is low. Remember, if the target is to free up 120 MHz of frequencies, 20 stations will be required to exit the spectrum. Repacking presents another conundrum. Any move to reconfigure the TV stations would be complex and dependent on multiple factors. Apart from time and cost of repacking, interference protection on the new channel would be a major concern. There is no dearth of controversies on the wireless operator side too regarding these auctions. Bigger carriers like AT&T and Verizon want an open and simple bidding mechanism with no spectrum caps. Sprint, T-Mobile and other smaller rural carriers want an upper limit on the amount of airwaves that a bidder can buy. They claim that AT&T and Verizon already control more than three-fourth of commercial wireless spectrum below 1 GHz. Thus such a limit would promote consumer interest and encourage competition. Nonetheless, restrictions on spectrum bidding would reduce government’s revenue. There are divergent views on the channel block size and the size of economic areas (EA) too, although the spectrum is likely to be auctioned off in 5 MHz blocks. Appropriate utilization of the guard band frequencies is one more contentious topic. Internet companies like Google and Microsoft want unlicensed operations in that band, while the mobile telcos support only limited unlicensed spectrum. Given so many unresolved problems, the FCC delayed the 600 MHz incentive auctions until middle of 2015.

The regulator clearly needs to address issues of all stakeholders, but to be fair, this is an unprecedented situation and it is important to get it right even if that requires more time and discussion. The original plan was to have the order for this unique auction out by this spring, but that looks improbable now. The regulator must assuage the concerns of broadcasters in the order. Rules and guidelines must be transparent with a well-defined structure. The barriers to entry must be low and TV spectrum owners should be educated about the approximate amount of dollars that they can expect in exchange of their 6 MHz of spectrum. They must be encouraged to explore the channel sharing option too. A recent pilot project conducted by 2 stations in Los Angeles concluded that sharing the same broadcast spectrum is technically feasible. Also as part of the order, the repacking methodology must be clearly laid out with specific timelines and costs involved. Various technical parameters like interference protection should also be outlined. Broadcasters must be assured that repacking will not affect their services in any manner and to further convince them, they should be allowed to test the repacking model. The station owners should be made to understand that since less than 10% of US households completely rely on over-the-air television, the spectrum they are holding can be utilized more efficiently if allocated for wireless data services. The other key policy challenge is on the forward auction side. There are valid arguments both in favor of and against imposing restrictions on spectrum that be bought by a bidder, so a balance has to be struck to ensure maximum participation and a level playing field. Lastly, the software and systems have to be extensively tested before commencing the complicated process.

There is clearly a long road to travel before these auctions can be held. There have been some positive developments like the formation of Expanding Opportunities for Broadcasters Coalition (EOBC). EOBC represents broadcasters that are interested in these auctions and want to be a part of the rulemaking process in order to make this endeavor a success. But much more needs to happen. A well-designed competitive sale process encompassing all three stages is what the industry needs and if executed well, it can bring rich benefits to the consumers, promote competition and boost the economy. A successful auction would also influence other nations to follow suit. Now there is only shot at getting it right. The FCC seems to be working hard at it and basic idea sounds good, so let us hope for a result that is in best interests of all the stakeholders.