Archive

What struggling operators worldwide can learn from T-Mobile, USA?

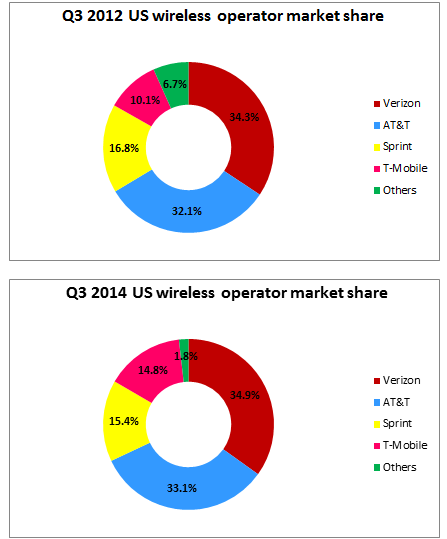

T-Mobile is the fourth largest wireless network operator by subscribers and revenue in the United States. Germany’s Deutsche Telekom owns two-third of the company. The telco manages to grab the most headlines out of any telecom company in the US because of some good reasons. Let us start by looking at a few numbers first. T-Mobile reported 3Q 2014 revenue of $7.35 billion and added about 2.35 million subscribers over the quarter (more than any other operator in the US). It has added 10 million customers in the last year and a half. The two comparison charts below should help explain the story. Considering that much of the subscriber growth is coming from non-phone categories for bigger carriers, it is clear that T-Mobile has managed a respectable growth in a saturated market. While some of this growth came from the acquisition of MetroPCS, the bottom line is that no other operator has managed a faster increase in the total number of connections. Note that the market share here includes wholesale numbers.

The turnaround of T-Mobile ironically started with AT&T’s failed acquisition of the company. As a reverse breakup fees, T-Mobile earned $3 billion in cash and rights to $1 billion worth of spectrum. The operator milked this wonderful opportunity and started off on the road to revival. The following content will shed light on how T-Mobile impacted the industry deeply and managed this revival. Indeed there are some lessons in here for those service providers that are losing both money and subscribers in this business –

- Leader can make a big difference – T-Mobile appointed John Legere as the CEO in September 2012. Much of T-Mobile’s recent success has been attributed to John’s maverick tactics. He dared to follow the ‘Un-carrier’ approach. Every few months, T-Mobile comes up with a tempting customer offer that becomes the talk of the industry. Known for his colorful personality, the company’s leader does not hesitate to take regular jabs at his competitors. Some may not like his style but it keeps up the aggression and instills confidence in both employees and customers.

- Innovation has to continue – There is no substitute to creativity and fresh ideas even in the face of adverse headwinds. This is risker for a struggling business, but still a far better option than the status quo. In a country where 2 year contracts and subsidized phones were prevalent, T-Mobile dared to introduce plans with no annual service contracts, faster upgrades and free international roaming. Such plans were music to the ear of customers, but were financially stressful for the operator. Nevertheless, innovation did not stop.

- Change the rules of the game – This flows directly from the point made above. Do not hesitate to take the untraveled road. T-Mobile started following this adage about 18 months ago and here is what they have done so far to get back into the market –

- Un-carrier 1.0 – Simple choice plan was introduced that offered unlimited voice, text and data for $70. Cheaper options were available with limited data. Annual contracts were eliminated and devices were not linked to the plan anymore. Phones could still be financed, but customer had the freedom to quit at their will.

- Un-carrier 2.0 – T-Mobile allowed upgrades to a new phone twice every year using the JUMP (Just Upgrade My Phone) plan. In other words, upgrade when you want to not when you are told to. Multiple options were available to trade-in the old phones and existing customers got same phone deals as the new ones. Phone insurance was included.

- Un-carrier 3.0 – Under the Simple Global plan, data and text were made free while roaming internationally in 100 countries. Voice calls were charged at 20 cents/minute. More countries are being added periodically. While the free data roaming is at slower speeds and special packs must be purchased for 3G or higher speeds, this still saves hundreds of dollars for many regular travelers.

- Un-carrier 4.0 – Perhaps the most consumer-friendly move, T-Mobile offered to pay up to $350 in ETF or the Early Termination Fees for subscribers willing to leave rival operators. Also as part of their fourth un-carrier strategy, they started offering cheaper iPads and plans with no overage charges.

- Un-carrier 5.0 – T-Mobile allowed anyone to test drive their network for a week with iPhone 5S. This was wonderful for those who were not sure about the T-Mobile network. It also helped raise awareness about the presence of iPhone with the nation’s fourth largest operator.

- Un-carrier 6.0 – Under the ‘Music Freedom’ initiative, music streaming from popular Internet radio services was made free and independent from the data limits. Pandora, Rhapsody, iHeart Radio and iTunes Radio were all in this list.

- Un-carrier 7.0 – With ‘Wi-Fi Unleashed’, every new smartphone from T-Mobile was made Wi-Fi calling and texting capable. This is great for customers living in a low network coverage area. The telco also begun offering an 802.11ac compatible Personal Hotspot last month to enable Wi-Fi calling using a home broadband connection. A new free in-flight texting and visual voicemail feature compatible with the Gogo service was also announced.

- Challenge the bigger players and they might follow you – Initially complacent about their strong position, the big two – Verizon and AT&T (and even Sprint) were forced to take note of the revolution ushered by T-Mobile in the American wireless space. Verizon’s Edge and AT&T’s Next were the early upgrade versions of these two service providers. Sprint too raced to match prices on their individual and family plans. T-Mobile was ultimately responsible for the never ending price wars that are great for the consumers. It has changed the concept of brand loyalty for good and aligned the US wireless industry more with global practices.

- Short term loss can be long term gain – All these strategies to attract new customers are obviously not coming for free. T-Mobile is gaining new subscribers but is taking a hit financially. While revenue momentum has continued, the telco lost $94 million or 12 cents a share in the most recent quarter. But this will not deter T-Mobile and its CEO. Once they can get enough subscribers to like their service, turning around operations to make them profitable would not be difficult. Deutsche Telekom’s backing provides a good support system.

- No substitute for good customer service – Irrespective of the business you run, the importance of customer service cannot be underestimated. This is even more significant for a telecom service provider who directly deals with the customer. Poor network quality, inflated bills and adding or removing services are some of the top issues that reach a carrier’s service center. Think about how we all frequently grumble about inept customer service from the mobile telecom provider. However on a relative basis, T-Mobile has been frequently ranked above its competitors through the years on this parameter. Few years ago when I was their customer, this remained an aspect I liked about their service. Both T-Mobile and their MetroPCS brand topped the JD Power’s latest 2014 Wireless Customer Care Ratings.

- Never ignore network quality – The quality of network along with pricing remains the core factor in the customer decision making process. Even a struggling operator should not undermine the network. Along with all their Un-carrier moves, T-Mobile has been enhancing the network at a faster pace as compared to its rivals. It was already building out the LTE network towards the end of 2011. This deployment was accelerated after they got cash and spectrum from AT&T. 250 million US residents are covered by the T-Mobile LTE network currently and the operator expects to reach more than 300 million people in another year or so. Remember, getting to those last 50-60 million people is always the toughest in a vast country like US. T-Mobile has lighted up VoLTE (Voice over LTE) nationwide. Among first to debut LTE-Advanced features last year, they have been using 15 and 20 MHz wide LTE bands for deployment in many areas nationwide. T-Mobile also bought valuable 700 MHz spectrum from Verizon and is looking to aggregate their 700 MHz, 1700/2100 MHz (AWS) and 1900 MHz holdings towards providing speeds greater than 100 Mbps. Their network has been climbing up the ranks in terms of data speeds.

The option to switch providers remains an individual’s prerogative and the intent of this post is not to drive anyone towards T-Mobile. T-Mobile itself has a lot of work to do before becoming stable in the long term. But the point is that it has achieved substantial success in the US wireless business. Suitors have been coming too. After AT&T, Sprint wanted to merge with T-Mobile but the proposal was set to face regulatory hurdles. Iliad of France showed interest and Dish Network still remains a potential suitor. T-Mobile has changed the US wireless industry forever and in the process has lifted its own reputation and connection numbers. Sprint is fighting back under the new CEO, but if current trends continue, T-Mobile could surpass Sprint to take the number 3 slot in the US wireless space by early next year. A lot of credit for that must go to the man who leads this organization.