Archive

Wireless telecom infrastructure market worldwide – Trends and developments

With the proliferation of mobile technology in multiple aspects of our lives, much of the talk and analysis is about operators and consumer devices. However, playing an important role in the whole experience are the vendors who manufacture and supply the equipment behind cellular infrastructure. Many big players exist in the broader telecom space, but as with other content on this site, the focus here too will be on the wireless side. According to the telecom market intelligence firm, SNS research, the global wireless network infrastructure market stood at $52 billion last year and will remain about the same for 2014. UK-based Visiongain estimates this market to be around $47 billion. The contradiction between both reports is that while the former projects a flat or minimal growth for the wireless equipment market, the latter predicts the market to grow considerably over the next few years. I am inclined to say that this business will continue growing albeit slowly. The two reasons are LTE and LTE-Advanced roll-outs. Most operators worldwide are not investing in 2G anymore, while 3G infrastructure is still generating a substantial portion of the revenue. But the growth is all towards 4G. LTE operations and coverage are still at a nascent stage in most countries of the world. Additionally, there would always be a demand for more capacity, speed and spectral efficiency. LTE now generates half of wireless infrastructure revenue globally and according to Gartner, it will account for 80% of mobile network infrastructure spending by 2018. However, the uptick in sales would be slow as LTE growth will be at the cost of reducing 3G business and this cycle will continue with each evolving generation.

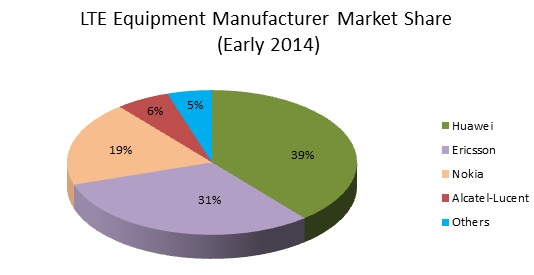

Given the importance of LTE and its advanced versions for the telecom manufacturing business, it would be worthwhile to look at the market share of top vendors worldwide. This is based on publicly available data on LTE contract commitments (fulfilled and unfulfilled) as of beginning of 2014. Most of these contracts are end-to-end covering both the radio and core aspects of LTE network.

Market share can be seen from multiple angles. The above chart only takes into account the total number of contracts and this remains the most common method of analyzing this market. While more recent LTE contract numbers are available for some manufacturers, early 2014 numbers have been used here since reliable information was available for every vendor at that timeline. Wireless network manufacturer market share can also be assessed in terms of the total worth of each of those contracts. Total subscribers served by the operators that buy the equipment from a specific vendor can be another parameter. Surprisingly, the race between Huawei, Ericsson and NSN is very close if looked in terms of end user numbers. Wireless equipment manufacturing is one of the most competitive areas of telecommunications. Here is a brief summary of each vendor’s market position –

Huawei – Shenzhen, China based Huawei is the largest telecom infrastructure manufacturer in the world. The company reported total sales revenue of $21.8 billion for the first half of this year clocking a 19% annual growth rate. They did not provide specific numbers from the wireless business for this year. At the end of 2013, its total full year revenue came in at $39.5 billion with an operating profit of $4.8 billion. The wireless revenue stood at $8.7 billion. About a quarter of this came from LTE and Huawei is striving to double its LTE revenue this year. Huawei has 290 commercial LTE contracts currently and about half of these have been deployed. It had 241 such contracts till the end of last year. Predictably, the vendors’ major customers are the 3 Chinese service providers with China Mobile being the biggest among them. Starting from the first LTE contract with TeliaSonera in 2009, Huawei has signed major LTE deals with Vodafone (for their worldwide network upgrade), EE – UK, Telenor – Norway, Etisalat – UAE, MegaFon – Russia and Softbank – Japan. It is strong in Europe, Middle East and Asia-Pacific. Huawei’s main challenge is lucrative markets like USA and India where they have not been able to enter in a big way because of security concerns.

Ericsson – Stockholm, Sweden headquartered Ericsson has been among the strongest and most stable telecom industry players globally. For the first half of 2014, the company declared sales of $14.9 billion and this was down 4% as compared to the same period last year. Network revenue stood at $7.8 billion for this time period. Bulk of network revenue came from the wireless segment although Ericsson does not provide specific numbers for the wireless side. The vendor’s full year sales for 2013 were $34.9 billion with an overall income of $2.8 billion. Network segment revenue was $18.2 billion, little more than half of the total sales (financial figures in USD could vary based on currency fluctuation). Ericsson reportedly has more than 190 LTE contracts out of which 140 have gone live. Some of their big LTE customers are Vodafone, SK Telecom – Korea, Orange – France and Verizon, AT&T – USA. Building on its existing 2G/3G relationship, it wasn’t difficult for Ericsson to grab the lucrative LTE build-out agreements with US carriers. Consequently, Ericsson’s primary source of network revenue has been North America followed by Western Europe and Northeast Asia (South Korea and Japan). Ericsson always had solid reputation as a telecom equipment manufacturer, but now faces fierce competition from Chinese players. With initial LTE deployments in US almost wrapped up, the company has witnessed slowing sales. It is now focusing more on developing markets like China and India.

Nokia (NSN) – Nokia Solutions and Networks, formerly Nokia Siemens and Networks is based in Espoo, Finland. In the January-June 2014 time frame, net sales for NSN were $7.5 billion and this was a decrease of 11% on yearly basis. The mobile broadband revenue (NSN’s terminology for wireless equipment sales) was $3.5 billion for H1 of 2014. Nokia’s reported 2013 revenue was $15.2 billion with an operating profit of $1.5 billion. The revenue from mobile broadband business unit for the year was $7.2 billion. They have 145 commercial LTE contracts currently and had 117 such contracts at the beginning of this year. NSN is considered to be the top foreign vendor in China. It won a double digit share of China Mobile’s TD-LTE contract recently. A few notable operators that are buying LTE equipment from NSN are Vodafone – New Zealand, Vimpelcom – Russia, TeliaSonera – Sweden, STC – Saudi Arabia, and T-Mobile USA. Overall, Nokia is strongest in Asia and Middle East followed by Northern Europe. After selling the handset business to Microsoft and buying out Siemens’ stake in the joint venture, Nokia’s full focus is on their networks business and they have delivered good results in the past couple of years. But the road to recovery is long as it works to dissociate itself from the mobile phone brand. Like Ericsson, aggressive price competition is hurting NSN too.

Alcatel-Lucent – Paris based Alcatel-Lucent, the owner of prestigious Bell Labs, is No. 4 in the mobile telecom infrastructure business. During the first 6 months of this year, Alcatel-Lucent reported total revenue of $8.5 billion that was down 4% as compared to the same time frame in 2013. The Wireless ‘Access’ revenue for that duration was about $3.1 billion. For the full year 2013, the total revenue was $19.9 billion with an operating income of $395 million. Wireless equipment revenue stood at $6.1 billion last year. Alcatel-Lucent’s LTE revenue grew 70% in 2013 on an annual basis. The vendor had 40 LTE contracts till early 2014 although that figure has risen to 45 recently. Alcatel-Lucent counts Verizon, AT&T and Sprint – USA, America Movil – Latin America, Telefonica – Spain and China Telecom among its top customers. It has a lot of exposure to Americas and this will have a negative impact on the company once deployments in US slow down. Alcatel-Lucent’s LTE business is growing with lots of potential opportunities, but the company as a whole is not out of the woods yet. Because of weaker financial position and a single digit market share, industry experts believe Alcatel-Lucent’s wireless portfolio if combined with Nokia, can bring rich dividends to both these companies.

Apart from the top 4, Samsung and ZTE are other smaller but growing players in the wireless equipment space. They had been mostly focused on their home markets, but have recently gained traction in other regions too. Looking at above analysis, one notices that many big telcos sell contracts to multiple vendors. Also, with total LTE subscriptions predicted to cross the billion mark in 2017, LTE is the area of growth. Operators in USA, South Korea and Japan are already deploying LTE-Advanced and this is the next big opportunity. All players are refining their small cell and VoLTE strategies. They are also looking to reduce the complexities of base stations. This will make the vendor battles even more interesting. Keep watching this space for more updates on mobile telecom equipment supplier market.