Archive

Wireless telecom infrastructure market worldwide – Trends and developments

With the proliferation of mobile technology in multiple aspects of our lives, much of the talk and analysis is about operators and consumer devices. However, playing an important role in the whole experience are the vendors who manufacture and supply the equipment behind cellular infrastructure. Many big players exist in the broader telecom space, but as with other content on this site, the focus here too will be on the wireless side. According to the telecom market intelligence firm, SNS research, the global wireless network infrastructure market stood at $52 billion last year and will remain about the same for 2014. UK-based Visiongain estimates this market to be around $47 billion. The contradiction between both reports is that while the former projects a flat or minimal growth for the wireless equipment market, the latter predicts the market to grow considerably over the next few years. I am inclined to say that this business will continue growing albeit slowly. The two reasons are LTE and LTE-Advanced roll-outs. Most operators worldwide are not investing in 2G anymore, while 3G infrastructure is still generating a substantial portion of the revenue. But the growth is all towards 4G. LTE operations and coverage are still at a nascent stage in most countries of the world. Additionally, there would always be a demand for more capacity, speed and spectral efficiency. LTE now generates half of wireless infrastructure revenue globally and according to Gartner, it will account for 80% of mobile network infrastructure spending by 2018. However, the uptick in sales would be slow as LTE growth will be at the cost of reducing 3G business and this cycle will continue with each evolving generation.

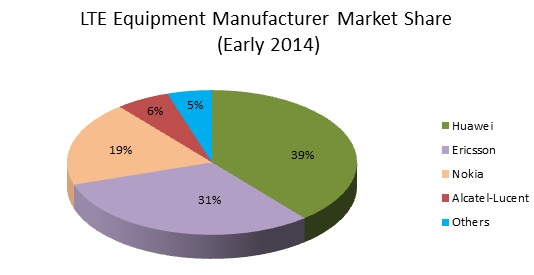

Given the importance of LTE and its advanced versions for the telecom manufacturing business, it would be worthwhile to look at the market share of top vendors worldwide. This is based on publicly available data on LTE contract commitments (fulfilled and unfulfilled) as of beginning of 2014. Most of these contracts are end-to-end covering both the radio and core aspects of LTE network.

Market share can be seen from multiple angles. The above chart only takes into account the total number of contracts and this remains the most common method of analyzing this market. While more recent LTE contract numbers are available for some manufacturers, early 2014 numbers have been used here since reliable information was available for every vendor at that timeline. Wireless network manufacturer market share can also be assessed in terms of the total worth of each of those contracts. Total subscribers served by the operators that buy the equipment from a specific vendor can be another parameter. Surprisingly, the race between Huawei, Ericsson and NSN is very close if looked in terms of end user numbers. Wireless equipment manufacturing is one of the most competitive areas of telecommunications. Here is a brief summary of each vendor’s market position –

Huawei – Shenzhen, China based Huawei is the largest telecom infrastructure manufacturer in the world. The company reported total sales revenue of $21.8 billion for the first half of this year clocking a 19% annual growth rate. They did not provide specific numbers from the wireless business for this year. At the end of 2013, its total full year revenue came in at $39.5 billion with an operating profit of $4.8 billion. The wireless revenue stood at $8.7 billion. About a quarter of this came from LTE and Huawei is striving to double its LTE revenue this year. Huawei has 290 commercial LTE contracts currently and about half of these have been deployed. It had 241 such contracts till the end of last year. Predictably, the vendors’ major customers are the 3 Chinese service providers with China Mobile being the biggest among them. Starting from the first LTE contract with TeliaSonera in 2009, Huawei has signed major LTE deals with Vodafone (for their worldwide network upgrade), EE – UK, Telenor – Norway, Etisalat – UAE, MegaFon – Russia and Softbank – Japan. It is strong in Europe, Middle East and Asia-Pacific. Huawei’s main challenge is lucrative markets like USA and India where they have not been able to enter in a big way because of security concerns.

Ericsson – Stockholm, Sweden headquartered Ericsson has been among the strongest and most stable telecom industry players globally. For the first half of 2014, the company declared sales of $14.9 billion and this was down 4% as compared to the same period last year. Network revenue stood at $7.8 billion for this time period. Bulk of network revenue came from the wireless segment although Ericsson does not provide specific numbers for the wireless side. The vendor’s full year sales for 2013 were $34.9 billion with an overall income of $2.8 billion. Network segment revenue was $18.2 billion, little more than half of the total sales (financial figures in USD could vary based on currency fluctuation). Ericsson reportedly has more than 190 LTE contracts out of which 140 have gone live. Some of their big LTE customers are Vodafone, SK Telecom – Korea, Orange – France and Verizon, AT&T – USA. Building on its existing 2G/3G relationship, it wasn’t difficult for Ericsson to grab the lucrative LTE build-out agreements with US carriers. Consequently, Ericsson’s primary source of network revenue has been North America followed by Western Europe and Northeast Asia (South Korea and Japan). Ericsson always had solid reputation as a telecom equipment manufacturer, but now faces fierce competition from Chinese players. With initial LTE deployments in US almost wrapped up, the company has witnessed slowing sales. It is now focusing more on developing markets like China and India.

Nokia (NSN) – Nokia Solutions and Networks, formerly Nokia Siemens and Networks is based in Espoo, Finland. In the January-June 2014 time frame, net sales for NSN were $7.5 billion and this was a decrease of 11% on yearly basis. The mobile broadband revenue (NSN’s terminology for wireless equipment sales) was $3.5 billion for H1 of 2014. Nokia’s reported 2013 revenue was $15.2 billion with an operating profit of $1.5 billion. The revenue from mobile broadband business unit for the year was $7.2 billion. They have 145 commercial LTE contracts currently and had 117 such contracts at the beginning of this year. NSN is considered to be the top foreign vendor in China. It won a double digit share of China Mobile’s TD-LTE contract recently. A few notable operators that are buying LTE equipment from NSN are Vodafone – New Zealand, Vimpelcom – Russia, TeliaSonera – Sweden, STC – Saudi Arabia, and T-Mobile USA. Overall, Nokia is strongest in Asia and Middle East followed by Northern Europe. After selling the handset business to Microsoft and buying out Siemens’ stake in the joint venture, Nokia’s full focus is on their networks business and they have delivered good results in the past couple of years. But the road to recovery is long as it works to dissociate itself from the mobile phone brand. Like Ericsson, aggressive price competition is hurting NSN too.

Alcatel-Lucent – Paris based Alcatel-Lucent, the owner of prestigious Bell Labs, is No. 4 in the mobile telecom infrastructure business. During the first 6 months of this year, Alcatel-Lucent reported total revenue of $8.5 billion that was down 4% as compared to the same time frame in 2013. The Wireless ‘Access’ revenue for that duration was about $3.1 billion. For the full year 2013, the total revenue was $19.9 billion with an operating income of $395 million. Wireless equipment revenue stood at $6.1 billion last year. Alcatel-Lucent’s LTE revenue grew 70% in 2013 on an annual basis. The vendor had 40 LTE contracts till early 2014 although that figure has risen to 45 recently. Alcatel-Lucent counts Verizon, AT&T and Sprint – USA, America Movil – Latin America, Telefonica – Spain and China Telecom among its top customers. It has a lot of exposure to Americas and this will have a negative impact on the company once deployments in US slow down. Alcatel-Lucent’s LTE business is growing with lots of potential opportunities, but the company as a whole is not out of the woods yet. Because of weaker financial position and a single digit market share, industry experts believe Alcatel-Lucent’s wireless portfolio if combined with Nokia, can bring rich dividends to both these companies.

Apart from the top 4, Samsung and ZTE are other smaller but growing players in the wireless equipment space. They had been mostly focused on their home markets, but have recently gained traction in other regions too. Looking at above analysis, one notices that many big telcos sell contracts to multiple vendors. Also, with total LTE subscriptions predicted to cross the billion mark in 2017, LTE is the area of growth. Operators in USA, South Korea and Japan are already deploying LTE-Advanced and this is the next big opportunity. All players are refining their small cell and VoLTE strategies. They are also looking to reduce the complexities of base stations. This will make the vendor battles even more interesting. Keep watching this space for more updates on mobile telecom equipment supplier market.

Will Reliance disrupt the wireless industry in India once again?

The big news from the Indian telecom industry is that the two scions of country’s biggest business empire, the Reliance Group, are joining forces. This is no small development. Their complimentary assets and loads of cash have led industry experts to believe that Reliance Jio Infocomm and Reliance Communications together will disrupt India’s telecom market. To briefly summarize the history of both organizations, foundation for Reliance Jio Infocomm was laid in 2010 when Mukesh Ambani owned Reliance Industries bought Infotel Broadband. Infotel was the only firm to win a pan-India license in the 2.3 GHz Broadband Wireless Access (BWA) spectrum auction. The operator is putting that spectrum to use. Later this year, the company plans to launch a TD-LTE network using 20 MHz spectrum. Reliance Communications (RCom) was originally founded by Mukesh Ambani too in 2002. At a time, when normal call rates were around INR 2, incoming calls were not free and most handsets were priced above INR 5000, RCom introduced subsidized phones for INR 501 and call rates as low as 40 paisa/min. (For reference purposes, 1 USD was about INR 46 at that time and is equivalent to INR 55 at current exchange rates). Although these call rates came with their own terms and contracts, it changed the whole telecom business in India. Call tariffs and phone prices, both headed south. Reliance was also the first telecom provider to launch CDMA services in the country. Due to feud between Mukesh and his younger sibling Anil, the Reliance Group companies were divided and the telecom business went to Anil Ambani. Currently, RCom is the third largest operator in India with a wireless subscriber base of about 120 million.

Reliance Infocomm is owned by the richest man in the country, Mukesh Ambani. It is on a solid footing with BWA spectrum in every part of the country. The next closest player is Bharti Airtel with 2.3 GHz airwaves in 8 of the 22 telecom circles (after Airtel bought rights to Qualcomm’s spectrum). Earlier this year, the Department of Telecommunications of India permitted the BWA spectrum holders to provide voice services over their 4G network. This is a clear boost to Reliance’s plans. It has been exploring the option of Voice over LTE services to solve the voice problem. Reliance’s investment will bring economies of scale to any technology or equipment that it chooses. Russia based Spirit DSP’s software will power the IP routed voice and video calls over Reliance’s LTE network. Samsung has been signed up as the equipment partner while IBM and Microsoft have been hired to provide other software services. A recent news report stated that AT&T is interested to pick up 25% stake in Reliance Infocomm, although there hasn’t been any official confirmation. Reliance has been conducting field trials in various parts of the country since last year. The actual commercial launch of its LTE services is expected to happen around mid-2013.

Reliance Infocomm was never very vocal about its plans until recently. There had been a lot of speculation in the industry on how it will setup the infrastructure. Finally, the company officially announced that it is signing an INR 12 billion deal with Reliance Communications which allows them to utilize RCom’s fiber backbone infrastructure. RCom would similarly have access to the infrastructure built by Infocomm in the future. While the deal is surely a shot in the arm for debt-ridden Reliance Communications, it puts Jio Infocomm in an even stronger position. A readymade backbone removes a major obstacle to their deployment plans. Not only this, their joint press release said, “This agreement is the first in an intended comprehensive framework of business co-operation between Reliance Jio Infocomm and Reliance Communications to provide for optimal utilization of the existing and future infrastructure of both companies on reciprocal basis, including inter alia, inter-city fiber, intra-city fiber, towers and related assets.” This is a clear indication of future partnerships between the two companies unless sibling rivalry gets in the way again. There is also high possibility that the collaboration will move beyond backbone sharing. Jio Infocomm could strike a deal to use RCom’s already deployed base stations across the nation. Apart from saving billions of rupees, it will put Jio’s LTE plans on fast track. The two operators can further share their software and hardware services. The ultimate evolutionary outcome of all these events could be the possible merger of Reliance Jio Infocomm and Reliance Communications. Such a combination would create a formidable player in the wireless business in India. It will have 2G, 3G and LTE spectrum as well as infrastructure. The platform to offer voice services would now be obvious. But any such merger will be fraught with challenges. The government of India still does not have clear policies on many telecom issues such as mergers and acquisitions. This has led to slew of imposed fines, judicial procedures and investor unease in the country. The National Telecom Policy of 2012 was intended to clear some air on M&A policies, but nothing is official yet. Hopefully the regulatory authority, TRAI and department of telecommunications will work in tandem to resolve such bottlenecks and put the telecom sector back on the growth path.

Looking at these developments from another perspective, till the time Reliance Jio Infocomm actually launches its services and successfully penetrates the market, it is too early to say whether they will be a disruptive force. The incumbents fear Mukesh Ambani because he has changed the rules of the game once before and he has deep pockets. But let us be clear that a new entrant in the market would have to fight on multiple fronts. Reliance’s entry would undoubtedly unleash tariff war. Jio Infocomm is expected to enter as a low cost data player. The initial target market would be the home wireless broadband subscribers who desire better data speeds at an affordable cost with no data caps. This segment holds vast promise and a huge untapped customer base. The only real competitor here would be Airtel which has already launched TD-LTE services for mobile broadband in 4 cities namely Kolkata, Bengaluru, Pune and Chandigarh. Unconfirmed reports put Airtel LTE subscriber base at 20,000. The growth is slow but the Average Revenue per User (ARPU) from such broadband service is much higher as compared to voice and churn rate is negligible. The quality of service and perception are also equally important factors for the urban tech savvy customer segment. There is still potential for growth in voice especially in the rural areas. But this would depend on the operator’s policy. Either they will use RCom’s existing network to offer voice or deploy it over their LTE network. The former step will be easier for grabbing market share and unless they merge, it would be interesting to see how Reliance Jio Infocomm and Reliance Communications come up with non-compete agreements. Device availability is another problem. Although wireless devices for accessing Internet are available in the 2.3 GHz band, there are no TD-LTE supporting phones in that band yet. Samsung is expected to launch smartphones which will fit the requirements of Reliance’s network. The collaboration between these two behemoths could lead to introduction of low cost locked phones, but again it is unknown that such a strategy will be effective with the customers. Remember, in order to capture market, the bigger challenge is to get the subscriber of another network to shift to your service. There is also a lot of talk about the competition between Bharti Airtel and Reliance’s new telecom venture. Airtel should definitely be concerned about Reliance’s grand entry. But Airtel also knows that it is a well-established telco with infrastructure and retails operations in every corner of India. It also has a better overall reputation as compared to most other service providers. The company has reorganized the organization structure and seems set for the Reliance challenge this time.

As this point, it is hard to say whether Mukesh Ambani’s re-entry into the wireless telecom sector will rewrite the rules of the games once more. With so much regulatory uncertainty, legal battles and a not so friendly telecom investor environment, it would be imprudent to predict the state of this industry a year or even six months from now. What we do know is that India’s wireless industry is closely watching Reliance Jio Infocomm’s every move. However, only time will show the magnitude of impact that this new telco will have on its competitors, partners and on top of all, the average customer.

Analysis of the Indian smartphone market

Mobile phone penetration has peaked out in many countries, although India still has untapped growth potential in that area. The number of active mobile subscribers in the country is about 700 million which represents less than 60% of the total population. Considering the fact that many subscribers have more than one phone, there is no denying that a vast population still doesn’t own a phone. Smartphone penetration is even lower in the country. Various recent estimates have put the number of smartphone users in the country at 44 million. This is 6.3% of the active subscriber population and 3.5% of India’s total population. According to the market research firm IDC, India had 2.5% share of the smartphone world in 2012. The same is predicted to reach 8.5% in 2016 and by that year, India would be the 3rd largest smartphone market. With a fast growing younger demographic and rapidly expanding economy, the country’s smartphone numbers are poised to expand at a much faster pace as compared to rest of the world.

Undoubtedly, all global smartphone manufacturers want a piece of the fiercely competitive Indian market. A 2012 report by CyberMedia Research on Indian smartphone business shows the following in terms of the respective market share of big brands.

|

Brand |

Market Share (%) |

|

Samsung |

41.6 |

|

Nokia |

19.2 |

|

Research in Motion |

12.1 |

|

Apple |

3.0 |

HTC, LG and domestic manufacturers like Karbonn, Micromax and Spice are rest of the major players not shown in the table. Now here is how it looks from the mobile ecosystem perspective.

|

Mobile OS |

Market Share (%) |

|

Android |

56.4 |

|

Symbian |

17.4 |

|

Research in Motion |

12.1 |

|

Bada |

8.5 |

|

iOS |

3.0 |

|

Windows Mobile |

2.6 |

Source: CyberMedia Research, India (2012)

We have to understand that statistics show only a limited aspect of the smartphone market. Some trends are global and not just India specific. Android has been the leading smartphone software for a while and it seems set to retain that crown for a few years. Symbian is on a terminal decline path globally and Windows Mobile OS is gaining users slowly but steadily. Unless RIM can break some new ground with their upcoming Blackberry 10, the company and its OS may be history in the next couple of years. In terms of handset makers, Samsung has a global lead primarily because of its wide device portfolio. Nokia’s smartphone business has steadily fallen, although recent press releases by the company have claimed a rebound in sales. Migration from Symbian to Windows will help Nokia, but it is still a tough road ahead for the erstwhile largest phone manufacturer of the world. Apple is the only company whose Indian market trends are not a reflection of its worldwide standing. Their iPhone was the unchallenged king of smartphones till about a year ago when Samsung came up with their blockbuster phones. Despite that, Apple has been gaining market share in many countries at the cost of RIM and Nokia. But their story is different in India where the company’s performance has not been able to match up to its big name. Primary reason is the lofty price tag. The 16GB variant of the iPhone 5 costs Rs. 45,000, which comes to over $800 at current currency conversion rates. There are no carrier subsidies or contracts. Most people in this world will not pay that much money for a phone. It is simple, will iPhone be this popular in US if it was sold for $800? The distribution channel is another concern for Apple in India. Till last year, operators like Bharti Airtel were directly selling the phone, but with the latest iPhone, the company has switched to third party distributors. This apparently has assisted Apple in simplifying the logistics of their iPhone brand in India. Although Apple recently launched the iTunes store in India, it is still not permitted by the government to open its own brick and mortar stores in the country. The company has been focusing its energies on China, but currently it does not see similar opportunities in the Indian market. Of course, this is the near term analysis and all this may change in the long term.

So what can be done for increasing the smartphone adoption in India? Here are some issues and their solutions –

- Pricing, Pricing, Pricing!!! – The importance of pricing for a consumer commodity in any part of the world can never be overemphasized. That is the main parameter which captures the mind of a consumer when he is exploring the market. The pricing factor is even more vital for an India consumer. The mobile phone and wireless services market in the country rose rapidly when both became more affordable for an average middle income user. A similar phenomenon has to happen in the smartphone arena too. Any phone manufacturer interested in India has to devise innovative measures to keep the costs low while building a user-friendly and feature packed phone. In some ways, this is already happening. Good smartphones from companies like Samsung and Nokia are available for less than Rs. 10,000. Apart from the phone pricing, affordable 3G and LTE data tariffs would also boost smartphones uptake.

- Internet connection source – The percentage of computer literate people in India is rising albeit slowly. For getting to the Internet, one requires both a computer and Internet connection. Compare this with a phone, with which the user can get on the Internet with substantially less investment. Obviously, the experience is not the same as compared to a tablet or a laptop, but for basic Internet tasks, smartphones are good enough and they cost substantially less. The average citizen has to recognize that buying a smartphone while is no replacement for a laptop, it can still be helpful as a standalone Internet connection at home. And one does not necessarily need to be computer literate to use a smartphone.

- Smartphone awareness – This aspect ties into the above factor about how exposure to Internet can help spread smartphone awareness. It is the responsibility of the handset manufacturer and the cellular operator to enlighten people about advantages of a smartphone. Emails, social networking (a.k.a Facebook), maps, weather, news reading, stock market updates, bill payments, travel bookings, gaming, playing music/videos, video chats and online shopping are some of the activities which can be performed on a smartphone with reasonable efficiency. In the end, apart from the cool factor for the younger generation, it will come down to the quality of life. Will smartphones make people more efficient? With all the social media, will it make social life better? Does the idea of video chatting with family and friends overseas sound good? Maps and GPS development in India still have a long way to go, but will getting directions save time and hassle while driving? How about buying a product online which is not available or is expensive in stores? Will smartphones help in making more money in the stock market? Can they help those involved in agriculture? Answers to these questions may vary depending on who you ask but those answers would influence the decision of buying a smartphone.

- Data Networks – For some mobile phone users, the rationale for not buying a smartphone is slow 3G or data network speeds. This is a chicken and egg situation. Operators ramp up speeds in their network when they see demand and subscribers switch to smartphones if their wireless network supports good bandwidth. However, once the data usage reaches a certain level, this problem automatically takes care of itself. For this, network operators have to ensure that providing a satisfactory quality of service to their existing subscribers will attract more data customers and thus more revenue.

- Application Ecosystem – Apple’s iOS and Google’s Android have enormous number of applications (apps) which work on their software. Many India specific apps have made their way to both operating systems, but a greater push is required. Bill payments for utilities, online shopping, reading restaurant reviews, checking news updates and sports scores are some of the tasks which can be carried out with phone apps.

- Growing Economy – India’s economic expansion has slowed down recently, but the nation is still expanding faster than most countries in the world. People have more dispensable income and better exposure to global products. This, along with numerous other benefits of swift economic growth will lead to a jump in smartphone adoption.

With all the advantages, smartphones have their own drawbacks. They always lead to an increase in phone bills. Like other technology gadgets, they get obsolete fast and need to be updated every few years. And on top of all this, smartphones can be social nuisance. Isn’t it annoying if a group of friends or family is having dinner and interesting conversation while some in that gathering are busy reading emails or checking in on Facebook with their phones? Smartphones can divert attention when one needs to be focused somewhere else.

In the end, the decision to buy a smartphone rests with the customer. In a developing country like India, the challenges faced by smartphones makers are intense. The only question is that can the smartphone manufacturers, wireless operators and government collaborate to put that increasing smartphone penetration on fast track? I think they can and they have to, it is just a matter of time. Smartphones are the inevitable future of mobile phones and that is the way it is going to happen in India too.